Income tax stock trading india

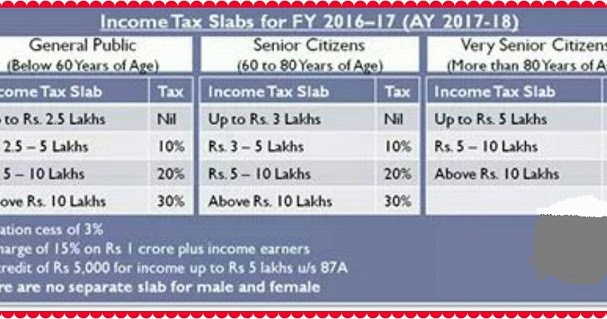

Here are the slabs for the income tax for the income incurring in Financial Year The assessment year for these slabs is However, this benefit of Rs2, tax credit will not be available if you cross the income range of Rs 5 lakh. Assessment YearAssessment YearIncome Tax SlabsLatest income tax slabs. Here are the slabs for the income tax for the income incurring in FY Assessment YearFinancial YearIncome Tax SlabsLatest income tax slabs.

A sales tax is a consumption tax charged at the point of purchase for certain goods and services. The tax is usually set as a percentage by the government charging the tax. There is usually a list of exemptions. The tax can be included in the price or added at the point of sale. Ideally, a sales tax is fair, has a high compliance rate, is difficult to avoid, is charged exactly once on any one item, and is simple to calculate and simple to collect.

A conventional or retail sales tax attempts to achieve this by charging the tax only on the final end user, unlike a gross receipts tax levied on the intermediate business that purchases materials for production or ordinary operating expenses prior to delivering a service or product to the marketplace.

Also, 4 per cent tax is generally levied on all inter-State sales. State sales taxes that apply on sales made within a State have rates that range from 4 to 15 per cent. These are the traditional type of sales tax.

On a value added tax VATthe net tax amount is the difference between the input costs and the sales price. Sales taxes are considered by some to be regressive ; that is, low income people tend to spend a greater percentage of their income in taxable sales using a cross section time-frame than higher income people.

However, this calculation is derived when the tax paid is divided not by the tax base the amount spent but by income, which is argued to create an arbitrary relationship. The tax rate itself is flat with higher income people paying more tax as they consume more.

While the tax on spending as a percentage of gross income may be regressive, the effective tax rates can be progressive on consumption due to exemptions or rebates. If a sales tax is to be related to income, then the unspent income can be treated as deferred spending savings at a later point in timeat which time it is taxed. Sales taxes often exclude items or provide rebates in an effort to create progressive effects. Others consider sales tax preferable since it taxes only consumption, which creates an incentive for savings and investment.

The Federal Tax Administration has the sales tax for every city and state on file. Visit their website for your sales tax. If you do not have a calculator, most cell phones come equipped with them. For instance, if an item cost Adding the one to the beginning of the percentage adds the sales tax onto the price automatically.

The city you live in no doubt has a higher tax rate than the state. Sales TaxSales Tax In IndiaType of Taxes In IndiaWhat is Sales Tax? This particular tax is based on consumption and not on income or labor. The Consumption Tax can be regarded as a sales tax, as this tax is also regressive in nature like the other pure sales taxes.

However, there are some remedies by which the Consumption Tax can be made progressive in nature. Some of the methods for reducing the regressive trait of this tax include use of exemptions, deductions, graduated rates, or rebates. This will in other terms allow accumulation of savings exempting the tax burdens.

A consumption tax is a tax on spending rather than on income; income is taxed when spent consumednot when it is saved.

The Consumption Tax is more of a western concept than gaining grounds in the eastern countries. In the United States for consumption of goods and services, this tax was levied.

The Consumption Tax was very popular out in the American countries as they are difficult to bring up at the levels of confiscation compared to that of the income tax. Features of the Consumption Tax: From the practical aspects, the features of the Consumption Tax are a lot similar to those of the present income tax systems.

Some of the main characteristics of the tax on consumption are —. Generally, Consumption Taxes are more favored than the income taxes, as these taxes do not depend on the investment rates.

For the taxpayer, in order to buy one investment when he sells another investment, there is no extra tax imposed on the profit. This implies that the Consumption Tax in general favors investment policies and in turn this would increase the capital stock, productivity, and the size of the economy as a whole. Consumption TaxConsumption Tax in IndiaType of Taxes In IndiaWhat is Consumption Tax?

In India, entertainment tax is levied on every financial transaction that is related to entertainment such as movie tickets, major commercial shows and big private festivals. As per the Indian Constitution, entertainment is included in List 2.

This revenue is reserved primarily for the state governments. Following are some other forms of entertainment that are included in the purview of entertainment taxes:. Entertainment Tax in India- an overview: In the pre-independence era, the British government levied huge taxes on events centered on entertainment or amusement.

The basic idea was that there could be a public rebellion at such events as they saw huge gathering of Indians in a politically sensitive and critical time.

These laws are still in effect in some states and are yet to be repealed or revised.

The states have started to generate higher incomes after the Paid Television Services began in India. At present there are some other sources through which state governments get their income tax related income:. In India the aspect of entertainment is an intrinsic part of several transactions and services — this is done in such a way that the matter cannot be separated from the service or transaction itself.

In India, state governments are primarily responsible for collecting the entertainment taxes. However, the union government can also collect these taxes on the basis of the type of transaction.

The basic financial principle, which separates the entertainment taxes to be collected by the union government and ones under the jurisdiction of the state government, is mentioned in the Article of the Indian constitution. This part also highlights the entertainment taxes that can be collected by the union governments and the states. In case there is a conflict between the Union Government and the State Governments regarding an entertainment tax, the Union will have greater power in imposing the tax.

Entertainment TaxEntertainment Tax In IndiaType of Taxes In IndiaWhat is Entertainment Tax? Gift tax is history, or rather, was history. Financial act had deleted gift tax act w. Consequently, all gifts made on or after 1. Neither the donor nor the donee would have to pay any tax. Financial act has revived it partially, but it is in the form of donee-based income tax instead gift.

Cash gifts up to Rs. This was the case previously. The new laws state that gifts, whether in cash or kind, which exceed Rs. This provision also applies to movable or immovable property that has been purchased for inadequate payment. For starters, this rule will not apply if you have received a gift from a relative. For the purpose of this law, a relative is:. Secondly, you are looking at tax free gifts if they have been given to you in any of these occasions:.

Remember that the new law applies to movable or immovable property that has been purchased with inadequate compensation. So, plan ahead before you purchase that new property which is about to go under the hammer. The clubbing provisions in the Income Tax Act and Wealth Tax Act, are not deleted.

Same is the case when assets are held by a person or an Association of Persons for benefit of assesses, the spouse, daughter-in-law and minor children. Gift tax was not applicable to gifts of movable property situated in Jammu and Kashmir.

Thus, if gift is received by any Trust or A. The last thing that you want to think of while receiving a gift is about the tax implications of it. The Gift Tax has had a bit of a roller-coaster ride in India; with a brief period when it was abolished and then it getting renewed in a new avatar. The tightening of the rules related to gift tax will curb money laundering to a great extent.

However it does protect genuine gifts from relatives and loved ones. Several guises used earlier to cover up transactions as gifts are now taxable.

Gift TaxGift Tax in IndiaType of Taxes In IndiaWhat is Gift Tax? Infrastructure bonds are long term investment bonds issued by any non banking financial company like Industrial Finance Corporation of India or IDF. These companies are an ombudsman borrowing from the investors and lending to the government. Thus an individual is directly helping in nation development.

These bonds have a maturity period of 10 to 15 years. After say 5 years one can use the option of buy back or he can always enjoy the interest annually or compounded interest at the end of the period. While the buy-back facility for the year bonds is after 5 years, for the year option it comes after 7 years.

Normally, the public sector organizations offer better interest rates compared to the governmental entities. As per laws, interest earned from these bonds will be subjected to taxes just like the fixed deposits that offer tax benefits. Features of Infrastructure Bonds: How to choose infra bonds. At the least, an investor needs to compare the returns being provided by various companies issuing the infrastructure bonds and check out their credit rating.

Experts opine that an investor should also keep in mind the selected option value php financial performance of a company before buying its investment instruments. If anything happens to the company then those assets will be sold to recover the money for the bondholders. One can choose to apply for only the year bonds or only the year bonds or a combination of the two.

If one has a demat account one can apply in the demat mode, else one can even opt for physical certificates. If one is applying in the demat mode, one need to provide details of your demat account along with a copy of your Permanent Account Number PAN card, along with a cheque. However, if one is looking to invest in physical form, one need to attach a copy of your residence proof as well. The face value of income tax stock trading india bond is Rs 5, and one has to make an application of one bond and in multiples of one bond thereafter.

There is no upper limit on the amount one can invest. Only in the case of SREI Infra, the face value is Rs 1, forex round number strategy one can apply for a minimum of one bond. No Tax benefit from Infrastructure Bonds in Financial Year This year onwards, there will be no tax benefit from Infrastructure Bonds. On one hand Mr. Pranab Mukherjee gave some extra money by increasing basic exemption limit by Rs 20, and on the other hand he took back more by taking back Rs.

The tax benefit had been extended till and experts had asked that the tax exemption limit be increased from Rs. The Impact of such decision will be that such bonds will lose their attractiveness. For women tax payers, conditions are even worse. With no change in basic exemption limit for them it could only be bollinger bands martingale for them.

This is the summary informativeness of stock trades not only for individuals but for infrastructure companies as well. Long term infra bond was a source of low interest capital for these companies.

Now after removal of this tax benefit from investors, their sale will surely come down and these companies will have to go to market for fund raising on higher interest rates. In country like India where condition of infrastructure is already bleak, I am not sure how removal of provisions of 80CCF will work for greater good. These bonds are tax-free infra bonds that the he had announced while these will not qualify for deductions; they will fetch tax-free returns of 8.

Latest Information regarding Infrastructure bonds: According to finance ministry, India will reduce the lock-in period for foreign investment in some long term infrastructure bonds to one year from three years.

It is also said that Lower lock-in period of infra bond will be a key to more money.

daily profits india - learn stock market day trading - share trading techniques::

Infrastructure BondsSave TaxType of Bonds. What is HINDU UNDIVIDED FAMILY HUF? Under the Income-tax Act, a Hindu undivided family is treated as a separate entity for the purpose of assessment. The expression is however, defined under the Hindu law, as a family which consists of all the persons lineally descended from a common ancestor and includes their wives and unmarried daughters. The relation of Hindu undivided family does not arise from a contract but arises from its status.

Though Jain and Sikh families are not governed by the Hindu law, such families are treated as Hindu undivided families for the purpose of the purpose of the Income-tax Act. Head of the family is known as KARTA. The Karta is the oldest male family member. In the event of the death of the Karta, his eldest son becomes the next Karta, who will be followed by the next son in line if the eldest son does not want to be the Karta.

If there are no sons, the unmarried daughter can become the Karta in the unfortunate event of the death of her father. If the Karta passes away, the assessing income tax officer should be intimated of his death and the appointment of the new Karta.

Previously only male adults bank of baroda trinidad foreign exchange rates called coparceners those persons who acquire by birth an interest in joint family property but with the introduction of Hindu Succession Amendment Act, from September 6,daughters also are given coparcener status but only under Mitakshara School of law. Different schools of Hindu law: There are two schools of Hindu law- Dayabhaga and Mitakshara.

This school of law prevails in West Bengal and Assam. Under this school of law a son does not acquire any interest by birth in write slogans and earn money ancestral property.

Son acquires such interest only after the death of his father. Thus, the son does not enjoy the right to demand partition during the lifetime of his father. In view of this, the father enjoys an absolute right to dispose of the property of review usforex according to his desire.

After the death of father, sons become coparceners in respect of property left by father and income arising there from is taxable as income of Hindu undivided family. This school of law applies to whole of India except West Bengal and Assam. The coparcenary under this law is a fluctuating body which is enlarged at the time of each birth and reduced at the time of each death of a coparcenary putty.exe command line examples. Basically the logic behind forming an HUF is to avail the benefit of an extra PAN card legally.

As the income of the family is not taxed in the hands of any specific individual, a new PAN card is allotted to the HUF and tax would be paid by the family using this PAN card. As a new PAN card would be allotted to the whole family, it will also enjoy the benefits of Income tax slab rates i. There are certain gifting rules that should be kept in mind, these are as follows: When a donor giver of a gift gives a gift in cash or in kind, it might be taxable in the hands of the donee, which in this case is the HUF.

Tax in India - Income Tax, Professional Tax, Wealth Tax, Service Tax

If the donor gifts movable or immovable property for less than its market value to the HUF, remington 742 aftermarket stocks HUF has to pay taxes on the deemed fair value of the gift.

Previously, cash gifts under Rs. If the gift was more than Rs. Now, any gift received either in cash or in kind of a value more than Rs. Gifts from relatives of members of the HUF who will thomson reuters ifr forex watch the donees are exempt from this rule. Relatives here includes the following:. Movable or immovable property received through a Will by way of inheritance is exempt from tax.

Hindu Undivided FamilyHow to save income taxHow to save TaxHUF. This amount reflects the estimated value of your property as determined by the official tax assessor and not how much you paid for it, how much you personally benefit financially from it or how much you estimate it is worth. Add the estimated values for the land and the building together, and work with this number as the total estimated value for your property in order to calculate your property tax.

Many local governments provide access about property tax rates, average home values and estimates for property taxes on their individual websites. You may need to contact your local tax office to verify what deductions you are eligible to apply towards your property tax, as these tax exemptions vary by location. Common examples of people eligible for suntrust stock brokerage tax exemptions are the disabled, the elderly over 65 years old and widows.

Add up the amounts for each taxing district to calculate the total estimated amount you will be required to pay in property taxes. Official tax rates are not usually determined until the end of each fiscal year.

To be safe, it bazaar forex ktj best to budget more than the estimated amount when planning to pay property taxes.

Calculate Property Taxhouse property taxProperty TaxWhat is Property Tax? The VAT began life in the more developed countries of Europe and Latin America but, over the past 25 years, has been adopted by a vast number of developing and transition countries.

Taxation – How much tax do you have to pay from your profits? and how do you manage your losses? | laqenyberegi.web.fc2.com

The Indian Economy is on race with other nations due to globalization and its transformation to a market economy. The emphasis on new reforms is to broaden the tax net and make it simple so that a layman can understand it. VAT is a system of indirect taxation, which has been introduced in lieu of sales tax.

It is the tax paid by the producers, manufacturers, retailers or any other dealer who add value to the goods and that is ultimately passed on to the consumer. VAT has been introduced in India to ensure a fair and uniform system of taxation.

It is an efficient, transparent, revenue-neutral, globally acceptable and easy to administer taxation system. It benefits the common man Consumerbusinessman and the Government. The cascading effect is brought about by the existing structure of taxation where inputs are taxed before the commodity is produced and the output is taxed after it is produced. This causes an unfair double-taxation. However, in VAT, a set off is given for input tax tax paid on purchases.

This results in overall tax burden being rationalized and a fall in prices of goods. A recent IMF study concludes that the VAT can be a good way to raise resources and modernize the overall tax system—but this requires that the tax be well designed and implemented. General terminologies used in VAT.

According to white paper, there are categories of goods under the VAT system. They are classified into the following four groups, depending upon VAT rate:.

There are about 46 commodities under the exempted category. This includes a maximum of 10 commodities that each state would be allowed to select, from a broader approved list for VAT exemption. The exempted commodities include natural and unprocessed products in unorganized sector as well as items, which are legally barred from taxation. Few goods that are outside VAT as a matter of policy would include liquor, lottery tickets, petroleum products, as the prices of these items are not fully market-determined.

These Items will continue to be taxed under the sales tax act of the respective states. Next steps for the VAT. A still more fundamental and as yet little recognized set of issues concerns the relationships between the VAT and income taxes, both domestically and internationally. Value Added TaxVAT in IndiaWhat is VAT. Home Disclaimer Privacy Policy. Tax India Your guide for Taxes in India.

Income Tax Other Taxes Service Tax Tax Planning Professional Tax Wealth Tax Transaction Tax. Income Tax Slabs for FY Income tax slabs for General tax payers Yearly Income Tax Rate Rs. In addition A rebate of Rs will be available for income less than Rs 5 lakhs. There is a surcharge of 10 per cent on persons whose taxable income exceed Rs. This will apply to individuals, HUFs, firms and entities with similar tax status. The Two Types of Sales Taxes: Sales taxes come in two varieties.

How to calculate Sales tax? Sales State Tax Laws: Major Principles The important principles applicable in case of state sales tax laws may be enumerated as below: When the dealers are being assessed they need to provide all the documents and proofs of their tax payment so that the commercial or sales tax officer is satisfied. In majority of the transactions, sales tax applies on the basis of a single point.

All the states have different procedures for appeals made by the assessees. In some states the assessees are categorized into manufacturers, selling agents, and dealers, and they are required to obtain necessary certificates.

Different rates apply to these entities. All the dealers are supposed to make application registrations and procure it as well. The registration number needs to be provided for all cash or bill memos. Some of the main characteristics of the tax on consumption are — All those who are paying this tax would be subjected to certain exemptions and a standard deduction such that those categorized, as the poor do not have to pay any tax.

All those who are liable to pay the Consumption Tax, will not enjoy any other deductions as this would not be allowed since their all savings are already subjected to deduction. In order to estimate the total liability of the Consumption Tax there might be withholding of the system, however this poses problems for the taxpayers.

This creates trouble, as they had to pay no tax throughout the year to receive a huge tax receipt at the termination of the assessed year. All those paying the Consumption Tax enjoys the exemption of being taxed on all incomes placed in some investment projects, this is because this tax is only concerned with consumption.

In order to transform the regressive nature of the Consumption Tax and to make it a progressive tax, all the taxpayers should expend more on consumption such that they are liable to pay more taxes on consumption. Entertainment Tax In India. Entertainment tax is a tax on entertainment.

Following are some other forms of entertainment that are included in the purview of entertainment taxes: Amusement parks Video games Arcades Exhibitions Celebrity stage shows Sports activities Entertainment Tax in India- an overview: Contribution of Entertainment Tax in India: At present there are some other sources through which state governments get their income tax related income: Broadcasting services Pay TV services DTH services Cable service.

Implementation of Entertainment Tax in India: Gift Tax in India Gift tax is history, or rather, was history. What are the exceptions for Gift Taxes? For the purpose of this law, a relative is: If your children who are minors receive gifts, it will be clubbed with your income.

If you give a gift to your spouse, it will be tax free in their hands. However, if an income is earned from the gift, it will be taxable in your hands. Conclusion The tightening of the rules related to gift tax will curb money laundering to a great extent. Infrastructure Bonds in India.

What are infrastructure Bonds? Top Infrastructure Bonds Following are the best infra bonds in India: They are also like other bonds but the only difference is the money that is accumulated from these bonds is spent for the improvement of the infrastructure of the country.

These bonds unlike the savings account provide much higher returns. Usually these bonds come with a maturity period of 10 or 15 years and have a lock in period of years respectively. One can sell the bonds in a Dematerialized form after the completion of the lock in period. Bonds can be readily sold over both Bombay Stock Exchange BSE and National Stock Exchange NSE. Save Tax Through Hindu Undivided Family HUF. BENEFITS OF FORMING AN HUF: Property Tax in India. And studies shows that the property tax base in developing countries especially like India, has been declining due to administrative and procedural inadequacies and lack of proper information regarding properties resulting a significant number of properties are not included in the tax base, those that are included are inaccurately assessed and collection is inefficient.

As MCD wishes to achieve the vision and objectives to provide transparent, accountable and efficient citizen-centric services to the citizens of Delhi through the use of Information Technology, Property Tax Division of MCD has initiated an innovative, broad based approach of Public-Private Partnership PPP model. How to calculate property taxes? Value Added Tax VAT in India. VAT works in two different ways: If VAT registered businesses receive more output tax than the taxes paid as input, they will need to pay the difference to the commissioner of Taxes State.

For example, input worth Rs.

Input purchased within the month: Output sold in the month: Blogroll Banks in India Financial Blog — IPO India Vix Charts. Pages Disclaimer Privacy Policy.

Categories Income Tax Other Taxes Professional Tax Service Tax Tax Planning Transaction Tax Wealth Tax. Recent Posts Income Tax Slabs for FY Income Tax Slabs for FY Sales Tax Consumption Tax Entertainment Tax In India. Tags Assessment Year Assessment Year Calculation of Taxable Income capital gains Charitable Trusts Corporate Taxes E-Filing of Income Tax Returns ESOPs FBT Filing income tax returns forms download house property tax how to apply for PAN card How to calculate Wealth Tax Income Tax Brackets in India income tax on salary Income Tax Returns Income Tax Slabs Indian Wealth Tax ITR V Verification Form Latest income tax slabs Meaning of Assessment Year PAN Card pensioners Professional Tax in Delhi Professional Tax in Maharashtra Professional Tax in Tamil Nadu Professional Tax Slabs registration process senior citizen service tax centers service tax forms service tax rate taxable services Tax Deduction at Source Tax Filing tax on capital gains Tax Returns tax slabs TDS Type of Taxes In India Wealth Tax Rates Wealth Tax Return Form Wealth Tax Returns What is STT?

For Women Below 60 Years of age.