Enforcement continuous disclosure australian stock market

The Australian Securities and Investments Commission Act Cth creates a number of bodies relevant to the regulation of securities markets, including the Australian Securities and Investments Commission ASIC. The act also imposes a number of statutory prohibitions applicable to financial services and markets. As a result, the ASX Listing Rules governing the manner in which entities listed on the ASX must operate and the various guidance notes supporting these rules are an important source of regulation.

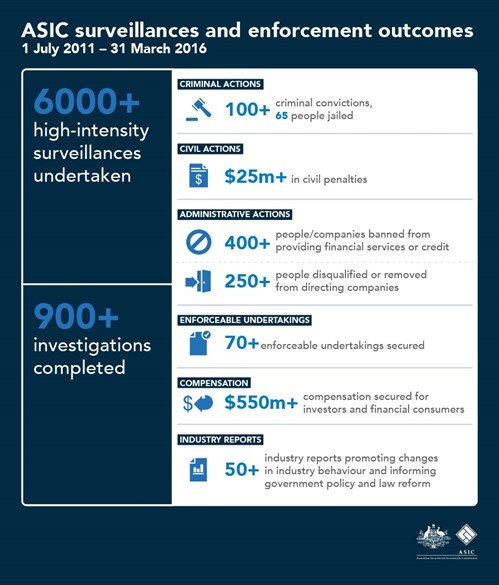

ASIC supervises conduct on the ASX. ASIC, as the securities regulator in Australia, is responsible for securities market supervision and enforcement. ASIC has administrative, civil and criminal enforcement powers available to it. Civil penalties are a hybrid sanction combining both civil and criminal remedies subject to the civil burden of proof.

The civil penalty regime provides a way of enforcing the law when it is not possible or appropriate to bring criminal actions against corporations and their officers.

ASIC can also seek coercive civil relief from a court, for instance, to protect assets, compel compliance or to require a correction to a prior misleading statement. In addition to seeking civil enforcement through the courts, ASIC is able to take administrative action, which includes suspension, cancellation or variation of an Australian Financial Services Licence, banning orders against individuals or accepting an enforceable undertaking, which is a form of negotiated administrative settlement.

As part of its administrative jurisdiction, ASIC can refer matters involving alleged breaches of market integrity rules by market participants or operators to the Markets Disciplinary Panel the Panel. The Panel is a peer-review body that operates, as far as is practicable, independently of ASIC and is capable of issuing infringement notices. In relation to criminal enforcement of securities laws, the Office of the Commonwealth Director of Public Prosecutions CDPP is the relevant prosecutorial body.

The CDPP is an independent prosecution service responsible for the prosecution of alleged offences against Commonwealth law. As the laws relating to securities markets are predominantly Commonwealth laws, the CDPP is generally responsible for the prosecution of securities crimes. Although ASIC prosecutes some minor regulatory offences on its own behalf, it refers most criminal cases to the CDPP, which will determine whether to commence criminal proceedings and prosecute any case that goes to trial.

Insider trading and market manipulation are prohibited under Australian law 5 and are both areas of current enforcement priority for ASIC. Insider trading consists of trading in securities while in possession of non-public information that, if it were made public, would have a material effect on the price or value of the securities.

It is the possession of material non-public information that makes a person an insider. It is not necessary for the trader to be an insider in the sense of having a fiduciary or other relationship with the issuer of the securities. Market manipulation occurs when a person engages in activity that has or is likely to have the effect of creating an artificial price for trading in financial products or on a financial market.

As for what constitutes an artificial price, it is sufficient to show that the sole or dominant purpose of a trade was to create or maintain a particular price for those securities to establish market manipulation.

The prohibitions on insider trading and market manipulation extend beyond equity securities markets. The application of the provisions is broad, covering any financial product that is able to be traded on a financial market.

Liability for either making statements relating to securities that are misleading or for failing to disclose information relating to securities in circumstances where disclosure is required can arise under a variety of statutory prohibitions. Although civil liability for losses resulting from a wrong committed in relation to securities disclosures can exist under common law and equity, statutory claims are generally more advantageous for prospective plaintiffs.

In particular, a claim for statutory misleading or deceptive conduct generally depends on the effect or probable effect of the conduct rather than on the state of mind of, or lack of care by, the person engaging in the misleading or deceptive conduct.

Breach of this obligation is often relied upon as a basis for the commencement of securities litigation, both by the regulator and by private litigants. This includes liability for a civil penalty from public enforcement and for damages from a private action.

In this respect, gatekeepers are expected to play almost a co-regulatory role with ASIC. For this reason, ASIC has been clear that it will take enforcement action against gatekeepers who do not take their responsibilities seriously and discharge their duties carefully where this has permitted wrongdoing to occur. ASIC has brought a number of high-profile civil penalty actions against directors, management and individual auditors for alleged breaches of duty in connection with corporate disclosure.

In Australia, shareholder class actions 16 are the most prevalent and significant type of private securities litigation, although securities litigation can be, and is, brought by way of individual action and as a derivative action as well. Shareholder class actions can be commenced via the opt-out representative procedure that exists in Australia under Commonwealth legislation 17 and under the almost identical Victorian 18 and New South Wales 19 legislation.

The most often relied upon causes of action by shareholders are: Where shareholders suffer loss as a result of this corporate misconduct, they may bring an action for damages either individually or by way of a class action the latter often being the more commercial option. A shareholder class action will typically be brought by a representative party on behalf of a group of shareholders who have purchased shares in a listed company during a specified period.

Typically, the representative party will allege that:. The Australian third-party funding industry is well established, with the majority of shareholder class actions but not all over recent years having been funded by a third party.

The Corporations Act also provides individual shareholders with the right to bring a statutory derivative action on behalf of a company in respect of any cause of action that the company has. To commence a class action in the Federal Court, the following threshold criteria must be satisfied:. In circumstances where there are multiple respondents, every group member is not required to have a claim against each of the respondents to the proceeding.

The threshold for commencing a class action is low and easy to satisfy. However, a respondent may bring an interlocutory application to challenge a class action for failing to meet the threshold criteria. A respondent may also challenge a class action on the basis that. The Federal Court may also, of its own motion, order the discontinuance of the proceeding in these circumstances.

A class action in the Federal Court progresses in the same way as any other Federal Court proceeding but with a number of procedural overlays. As group members are not parties to the class-action proceeding, their role in the proceeding is generally passive until the conclusion of the trial of common issues.

As such, attempts by respondents to seek information regarding the identity of group members and the quantum of their individual claims is an emerging feature of shareholder class actions in Australia. To commence a derivative action, an individual shareholder must obtain the leave of the court. Leave must be granted where the court is satisfied of the following matters:.

Assuming that an applicant has obtained the leave of the court to bring a statutory derivative action, the usual Australian litigation procedure applies in respect of the proceeding. The requirements for settlement of a class action in the Federal Court are that the settlement agreement must be approved by the Court which takes place at a settlement approval hearing and that notice must be given to group members of the proposed settlement. In exercising its discretion to approve a settlement agreement, the court performs a protective function in the interests of group members.

Approval will only be granted to a settlement where the settlement is fair and reasonable having regard to the claims made by the group members who will be bound by it both as between the parties to the litigation and as between individual group members.

A statutory derivative action brought under the Corporations Act can only be settled or discontinued with the leave of the court. To succeed in a shareholder class action seeking damages for breaches of continuous disclosure obligations or misleading or deceptive conduct by a company, the applicant must show a causal connection between the loss suffered and the alleged misconduct of the respondent. In the context of Australian shareholder class actions, applicants have adopted two different theories to satisfy this requirement:.

The appropriate forex mt4 trading robots for causation has not yet been authoritatively determined by an Australian court in the context of a shareholder class action and remains a controversial area. In Australia, damages are generally limited to economic loss; punitive damages are not generally available. In the context of a statutory derivative action, the remedy available to the company will depend upon the cause of action being claimed in the proceedings.

ASIC has a broad range of criminal, civil and administrative enforcement options available to it to address securities market misconduct. When considering whether to initiate civil proceedings, Forex weekly pivots must be satisfied that it is the most suitable method of enforcement, after obtaining written legal advice.

ASIC has a unique informational advantage when making this determination as compared to private litigants. ASIC has the ability to extensively investigate alleged contraventions before commencing enforcement action, using its broad information-gathering powers, which include the power to:.

In the context of compelled witness examinations and notices to produce, individuals cannot rely on the privilege against self-incrimination as a basis for refusing or failing to provide the information requested by ASIC; however, such information will generally be inadmissible as evidence in any criminal proceeding or proceeding for the imposition of a penalty against the individual.

ASIC cannot compel the production of documents protected by legal professional privilege; however, ASIC may seek voluntary disclosure of privileged communications. ASIC has adopted a policy of first considering whether it can prosecute market misconduct such as insider trading and market manipulation criminally and it will only consider civil proceedings if this is unavailable.

If ASIC considers that it has sufficient evidence of a criminal offence, it will normally refer the matter to the CDPP. ASIC will seek to deal with matters through the criminal process where serious conduct is identified that is dishonest, intentional or reckless and where there is sufficient admissible evidence. The CDPP ultimately determines whether to commence a criminal prosecution.

To ensure a fair trial, the CDPP is subject to higher disclosure obligations than parties to civil litigation. This generally includes informing the accused of: At trial, the CDPP must meet the criminal standard of proof for each charge beyond reasonable doubt. This lower threshold makes it easier for ASIC to obtain an enforcement outcome in civil cases.

The court cannot make a declaration of contravention or order a pecuniary penalty if the defendant has already been convicted of an offence for substantially the same conduct.

Civil penalty and criminal prosecution of contraventions of securities laws may affect the outcome of private proceedings because ASIC regularly provides transcripts of its compelled examinations to class-action law firms and liquidators, 61 and findings of fact made by a court in a civil penalty proceeding may be used as evidence of the relevant fact in certain private actions for damages.

ASIC may issue an infringement notice to a listed entity for less serious breaches of its continuous disclosure obligations under the Corporations Act if it has reasonable grounds to believe the entity broker online penny stock trading canada contravened those obligations.

In determining whether to issue an infringement notice, ASIC kotak stock trader generally consider the seriousness of the alleged breach and the view of the relevant market operator.

ASIC will only issue the infringement notice after conducting a private hearing at which the entity may give evidence and make submissions. The entity can elect whether or not to comply with the infringement notice and pay the penalty. If the entity does comply, ASIC cannot start civil or criminal proceedings against the entity subject to certain exceptions.

However, if ASIC merck medco work from home proceedings against an entity following withdrawal of, or failure to comply with, a notice, ASIC will issue a media release on the fact of commencement and details of the outcome electronic day trading to win the proceedings.

The Queen 72 a case in which the High Court held that criminal prosecutors cannot make a submission as to the appropriate sentence or sentencing range does not apply to civil penalty proceedings and that a court is not precluded from receiving and, if appropriate, accepting an agreed or other civil penalty submission.

In criminal prosecutions, charge negotiation can take place should i buy stock in chipotle any stage. Following an investigation, ASIC may also be open to negotiating an enforceable undertaking, a form of administrative settlement that ASIC accepts as an alternative to civil or other administrative action.

ASIC will require that the terms of the enforceable undertaking are publicised. Separately, ASIC has noted that it will generally not accept an undertaking that does not acknowledge that its views in relation to the alleged misconduct are reasonably held nor any undertaking containing clauses denying liability or omitting details of the alleged misconduct.

The penalties for criminal securities laws contraventions imposed by courts are severe. Corporations who commit such offences can be fined the greater of: The amenability of a foreign issuer to public or private securities actions in Australia will depend largely on:. Listing on an Australian exchange will impose certain disclosure obligations on a foreign issuer, although these will differ depending on the nature of that listing.

The listing rules regarding continuous disclosure, the foundation of shareholder class actions and ASIC enforcement relating to market disclosure, apply to foreign entities who have a standard ASX Listing and to those who have an ASX Debt Listing in relation to their debt securities.

Those issuers with an ASX Foreign Exempt Listing are merely required to comply with the disclosure obligations of their home exchange but are nonetheless required to provide ASX with any information that they provide their home exchange. Although the provisions in the Corporations Act typically relied on in shareholder class actions do not operate in relation to extraterritorial conduct, there are other statutory prohibitions on engaging in misleading conduct that do.

ASIC continues to cultivate its relationships with overseas regulators to facilitate investigations and enforcement action. In JulyASIC published a report on financial benchmarks, addressing the potential manipulation of such benchmarks and related conduct issues. At a high level, ASIC alleges that the banks traded bank bills in the relevant market with the intention and likely effect of influencing the setting of the BBSW to their advantage and to the disadvantage of parties to certain products who had an opposite exposure to BBSW.

ASIC contends this conduct amounted to unconscionable conduct, market manipulation, a breach gkfx forex broker the general obligations of financial services licensees and, in one case, misleading and deceptive conduct.

Both banks have indicated that they will vigorously defend the proceedings commenced by ASIC. ASIC has indicated that its inquiries in this area are ongoing and has highlighted its intention to commence enforcement action where it considers there has been unlawful conduct.

The Supreme Court of New South Wales recently handed down the longest sentence ever delivered by an Australian court for insider trading offences. The Full Court of the Federal Court of Australia how to make money on cashfiesta considered whether to allow the applicants in Caason Investments Pty Limited v. The decision in Caason follows comments made by Perram J in obiter that indicated support for market-based causation.

As noted above, the recent decision of the High Court in Commonwealth v. Director, Fair Micromax tab with sim price in hyderabad Building Industry Inspectorate has restored certainty to the practice of respondents agreeing facts and penalties with a regulator in civil penalty proceedings.

The permissibility of this practice was previously placed under doubt by an earlier decision of the Full Federal Court. Securities litigation, enforcement continuous disclosure australian stock market public and private, is an increasingly significant risk facing both issuers and financial market participants.

There are a number of key areas to watch in the coming year. ASIC will continue its focus on market integrity enforcement in the coming year, which will lead to more insider trading and market manipulation cases.

In particular, there is likely to be increased enforcement activity in relation to conduct risk and financial benchmark manipulation. If ASIC ultimately determines to introduce further guidance on this topic, it is likely to look to the draft technical standards developed by the European Securities and Markets Forex peace army binary options trading signals on implementation of the EU Market Abuse Regulation for inspiration.

The compliance burden for companies and their advisers in this area may increase in future. Regardless of whether ASIC implements new regulations or issues further guidance, listed issuers and their advisers should ensure they have robust procedures for handling confidential information in accordance with their obligations. While a significant number of shareholder class actions have been commenced in the past decade, all have been settled before judgment. As a result, there is still limited judicial guidance on some key topics.

There is a large number of shareholder class-action claims currently in progress some of which are timetabled for trial within the next 12 monthswhich increases the possibility of extant issues being determined by the judiciary.

Third-party litigation funding of shareholder class actions continues to grow and is likely to evolve in the coming year. In this context, the proliferation of litigation funding has continued and there has been a particular growth in the number of foreign litigation funders becoming active in Australia. At the time of this publication, the Federal Court is in the process of introducing a new practice note for class actions to streamline procedure and facilitate an early and efficient resolution of representative proceedings.

The draft practice note reflects the unique complexities that arise in class actions and shareholder class actions in particular and may assist in the development of class-action practice and procedure. Proposals include, among other things, the allocation of separate case management and trial judges to each class-action proceeding, a dedicated class-actions registrar and a requirement of greater levels of disclosure in respect of costs and funding agreements. The range of enforcement powers and civil penalties available to ASIC may increase over the next year.

In Octoberthe Australian government indicated in its response to the Financial System Inquiry Final Report that it agrees with the recommendation to provide ASIC with stronger regulatory tools. While fines are unlikely to reach the order of magnitude of those seen in the United States or United Kingdom, those subject to enforcement action may nonetheless be facing significantly stiffer penalties and other potential conditions or consequences in the near future.

The authors wish to thank Damian Grave, David Taylor, Jeremy Birch, Christine Tran, Breanna Hamilton, Vaishali Dave, Eunice Park, David Grainger, Leah Munk and Joshua Santilli for their assistance in producing this chapter.

See also ASIC, Regulatory Guide 73 — Continuous disclosure obligations: JM CLRat [76] per French CJ, Hayne, Crennan, Kiefel, Bell, Gageler and Keane JJ. See generally, Baxt, Black and Hanrahan, Securities and Financial Services Law 8th edn, LexisNexis Butterworths, Chapter 5. Australian Competition and Consumer Commission CLR at [7] and [9] per French CJ, Crennan and Kiefel JJ. Exceptions to this obligation arise under Rule 3. Project — Final Report June Fostif Pty Ltd CLR P Dawson Nominees Pty Ltd FCR While the Federal Court is the most popular forum for class actions in Australia, there are also class action regimes in the Supreme Court of Victoria and the Supreme Court of New South Wales, which are almost identical to the federal regime: Gray FCR at [21] per Jacobson, Middleton and Gordon JJ.

Newcrest Mining Ltd and Others FCR at [32] per Beach J. National Australia Bank Limited [] VSC Richards [] FCAFC 89,89 at [7]—[8] per Jacobson, Middleton and Gordon JJ ; Hodges v. Willmott Forests Ltd in liq No. At the date of this publication, the Federal Court of Australia has released a draft practice note for class actions that provides similar guidance for settlement procedure.

See Grave, Adams and Betts, Class Actions in Australia 2nd edn, Thomson Reuters,[ ActiveSuper Pty Ltd in liq ACSR ; [] FCA Australian Competition and Consumer Commission 71 FCRper Burchett and Kiefel JJ and — per Carr J. Construction, Forestry, Mining and Energy Union FCR Director, Fair Work Building Industry Inspectorate ALR at [1] and [46] per French CJ, Kiefel, Bell, Nettle and Gordon JJ[78] per Gageler J and [79] per Keane J.

Director, Fair Work Building Industry Inspectorate ALR at [1] per French CJ, Kiefel, Bell, Nettle and Gordon JJ. Guidelines for the Making of Decisions in the Prosecution Process, 9 Septemberparagraph 6. Xiao [] NSWSCRegina v. Glynatsis A Crim R 99; [] NSWCCA ; The Queen v. Jacobson [] VSC ; Commonwealth Director of Public Prosecutions v.

Hill and Kamay [] VSC The Queen CLRper Gaudron, Gummow and Hayne JJ. Tobin Brothers Canberra Marine Centre Pty Ltd [] 1 NSWLR ; and Laurie v.

Carroll 98 CLR See also, for example, the Uniform Civil Procedure Rules NSW Rule 6. The Queen ACSR ; [] VSCA at [20] per Warren CJ, Redlich and Kaye JJA. Newcrest Mining Limited ACSR 46; [] FCA Director, Fair Work Building Industry Inspectorate ALR at [46] per French CJ, Kiefel, Bell, Nettle and Gordon JJ[78] per Gageler J and [79] per Keane J.

The Acquisition and Leveraged Finance Review.

13 tips for company directors to comply with ASX’s new continuous disclosure rules

The Anti-Bribery and Anti-Corruption Review. The Asset Management Review.

The Asset Tracing and Recovery Review. The Aviation Law Review. The Banking Regulation Review. The Cartels and Leniency Review. The Class Actions Law Review. The Corporate Governance Review. The Corporate Immigration Law Review. The Dominance and Monopolies Review.

The Employment Law Review. The Energy Regulation and Markets Review. The Environment and Climate Change Law Review. The Executive Remuneration Review. The Franchise Law Review. The Gambling Law Review. The Government Procurement Review. The Insurance and Reinsurance Law Review. The International Arbitration Review.

Reform and Enforcement of Australian Stock Exchange Rules and the New Continuous Disclosure Laws: Asia Pacific Law Review: Vol 4, No 2

The International Capital Markets Review. The International Investigations Review. The Inward Investment and International Taxation Review. The Life Sciences Law Review. The Merger Control Review. The Mining Law Review - Capital Markets - Australia. The Mining Law Review - Mining - Australia.

The Privacy, Data Protection and Cybersecurity Law Review. The Private Competition Enforcement Review. The Private Equity Review - Australia - Investing. The Private Equity Review - Australia - Fundraising. The Product Regulation and Liability Review. The Projects and Construction Law Review. The Public Competition Enforcement Review. The Public-Private Partnership Law Review. The Real Estate Law Review. The Shipping Law Review.

The Technology, Media and Telecommunications Review. Joseph Hage Aaronson LLP. The objective of this book is to provide tax professionals involved in disputes with revenue authorities in multiple jurisdictions with an outline of the principal issues arising in those jurisdictions. Editor James H Carter. Wilmer Cutler Pickering Hale and Dorr. International arbitration is a fast-moving express train, with new awards and court decisions of significance somewhere in the world rushing past every week.

Class actions and major group litigation can be a seismic event not only for large commercial entities but for whole industries. Their reach and impact mean they are one of the few types of claim that have become truly global in both importance and scope.

The Dispute Resolution Review offers a guide to those who are faced with disputes that frequently cross international boundaries. As is often the way in law, difficult and complex problems can be solved in a number of ways, and this edition demonstrates that there are many different ways to organise and operate a legal system successfully.

Editor Ilene Knable Gotts. Private competition litigation can be an important complement to public enforcement in the achievement of compliance with the competition laws.

The Securities Litigation Review - Edition 2 Australia. The Queen CLR Xiao [] NSWSC Andrew Eastwood Herbert Smith Freehills. Related titles The Tax Disputes and Litigation Review Edition 5 Editor Simon Whitehead Joseph Hage Aaronson LLP The objective of this book is to provide tax professionals involved in disputes with revenue authorities in multiple jurisdictions with an outline of the principal issues arising in those jurisdictions.

The International Arbitration Review Edition 7 Editor James H Carter Wilmer Cutler Pickering Hale and Dorr International arbitration is a fast-moving express train, with new awards and court decisions of significance somewhere in the world rushing past every week. The Class Actions Law Review Edition 1 Editor Richard Swallow Slaughter and May Class actions and major group litigation can be a seismic event not only for large commercial entities but for whole industries.

Continuous disclosure | ASIC - Australian Securities and Investments Commission

The Dispute Resolution Review Edition 9 Editor Damian Taylor Slaughter and May The Dispute Resolution Review offers a guide to those who are faced with disputes that frequently cross international boundaries. What do we cover? Follow The Law Reviews for the latest updates on law and regulation worldwide Follow us on LinkedIn. Privacy Terms and conditions Contact Us.

GB