Charles lindsay trident a trading strategy

It is also by far the simplest, requiring little more than junior high school math to do the necessary calculations. I first learned about this amazingly precise method of analysis from a floor trader on the Pacific Stock Exchange named Ira Tunik.

At the time, Ira was using the cycles work of J. Hurst, a pioneer in the field of technical analysis, to make a very good living on the options floor. When he retired as a pit trader in the late s, he shifted his nest egg mostly into bonds, which at the time were providing annualized returns approaching 10 percent. However, when interest rates began to decline from those cyclical peaks, Ira realized he would need a foolproof trading strategy to live well off his savings without having to dip into principal.

Over the next year-and-a-half, Ira delved exhaustively into the world of trading systems, reading every book he could find on Elliott Wave Theory, Gann Angles, Pyrapoint, Fibonaccis, oscillators, stochastics — even astrology.

But for reasons explained below, it took us both several more years and many modifications to tweak the system into its present, very powerful form. The result was a rules-based system that, combined with a little street-sense, can outperform some of the most powerful black box systems ever devised. At the heart of the system is a simple observation — that stocks breathe in and out, and that for every zig in a chart there is a zag somewhere else that corresponds to it exactly.

Think of it as a flux of yin and yang energy seeking equilibrium at all times. Once you are able to identify the complementary zigs and zags, it becomes possible not only to discern the fundamental rhythms of the market, but to use this knowledge to predict price swings. Also, counter-trend entries are possible in the opening minutes of the day, when even the pros are typically on the sidelines waiting for the dust to settle.

The result is that we can gain a statistically significant edge on the most tedious, range-bound days. Everyone who has traded index futures has experienced such days: But what if you could initiate trades before a range had even been established — and at a price which to most other chartists would look like the middle of nowhere, so to speak?

That is exactly what the Hidden Pivot System allows you to do, enabling you to exit the market with a fat profit before the competition has had a second cup of coffee.

My Hidden Pivot rules are more visual than mathematical, and they can be applied to potent effect by anyone with the patience and diligence to monitor weekly, daily and intraday charts over time. Armed with this system, however, I am perfectly comfortable being a raging bull when the signs are right. How does the system work?

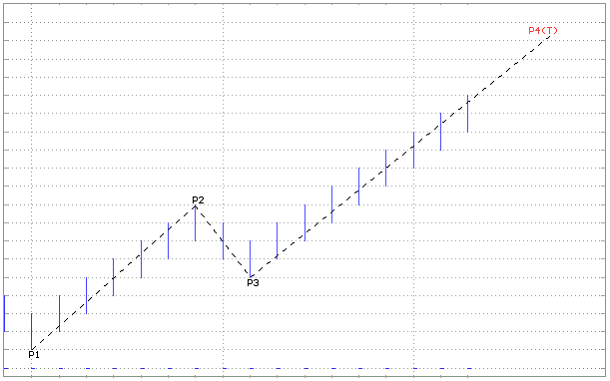

To start with, I always try to visualize the price movement of stocks, commodities, options and indexes in the perspective of an ABCD pattern such as the one shown above.

Unlike Elliott Wave Theory, which is rooted in trend patterns with five legs and corrections with three, my method distills all of the action down to three legs. It also sidesteps the often daunting task of distinguishing corrections from trend moves. Those who are familiar with Elliott Wave Theory know that even EWT experts sometimes bog down in the choppy seas of corrective patterns.

Terms such as expanded flats, extended or truncated fifths, double and triple threes, zigzags, and contracting, ascending and descending triangles are all part of Elliott Wave terminology, and they must all be mastered by the chartist who would attempt to forecast accurately and profitably. However, Hidden Pivot strategies, on the other hand, shun such complexities, focusing instead on the most fundamental rhythms of the market.

If you can distinguish good art from bad, you can learn the Hidden Pivot Method. So how do I keep from getting fooled or confused by corrective patterns? Simply by treating them, not as corrections, but as ABCD patterns unto themselves. Remember, I said that all price action can be reckoned in ABCD terms. This means that the B-C leg of the pattern above can itself be divided into an abcd structure, as follows:.

The subdivision yields no crucial information per se, but if one applies a simple test to the abcd pattern, specifically to its c-d leg, he will be rewarded with a cornucopia of tradable information. Ironically, the originator of the system never completely understood how powerful it was.

The Trident System was developed in the early s by a man named Charles Lindsay, who marketed it in seminar form with Larry Williams, commodity trader extraordinaire.

The seminar had an unusual marketing gimmick: Students could pay the hefty tuition fee out of trading profits.

Trident - Strategy

No profits, no fee. Trident is still available in book form from Windsor Publishing, but its rudiments can be encompassed in a single chart:. One obvious weakness of this system is that it limits itself to just a single entry point along the entire length and breadth of the ABCD pattern.

In the chart above, assuming it is of daily-bar magnitude, that could mean two or three week of waiting for one good entry opportunity. What better sign than a nascent uptrend?

Typically, the comfort zone for buying this rally belatedly would occur somewhere around point X. Then, as we know all too well, XYZ shares will fall just far enough to stop the herd out somewhere below point C. Specifically, we tossed out the notion that only point X works as an entry spot.

By watching this pattern play out many thousands of times on the one-, five-, and fifteen-minute bar charts, we were able to determine more than a dozen additional entry points, both long and short, along the path of ABCD.

In the chart below, this implies you would get long at A; short at B; long at C; even longer at X; take partial profits at P; and exit at D — or even reverse the position by shorting at D.

The system would be a winner if it merely yielded the microscopically accurate swing points that it does. But in fact it can do much more. An especially powerful feature of the system is that it can determine at all times which trend is dominant — up or down.

By observing price action at the midpoint of follow-through legs i. I like to reply simply that we are not trading against the trend; rather, we are initiating positions at the very first tick of new trends. Indeed, the system is so accurate that bids must often be placed a tick above or below tradable swing points, since buying or shorting at the actual pivot risks missing the trade because of liquidity problems.

In practice, I do not usually initiate trades at hidden pivots that are coincident with support and resistance lines, trendlines, Fibonaccis and other price points that are widely observed and likely to be well anticipated.

And what better way to start the day than with a profitable trade executed amidst what most traders would describe as opening-hour chaos? This system not only makes it possible to do so, it also allows rigorous control of risk to a degree that is all but impossible to achieve with other methods. Regardless of what I achieve trading-wise in the future I will always consider Rick Ackerman the person that taught me to be a trader.

Paul Coghlan Stock market analyst using Hidden Pivot strategies and analysis. It literally has to be seen to be believed and I would encourage others to confirm what I am saying by taking his free trial.

RoadRunr — Alpha Judge Reviewer Technical options trader using Hidden Pivot strategies and analysis. As a retired CTA I have never seen anything as prescient as your Black Box Forecasts. On my very first trade with you September 14 , the long bond had closed at I entered the entire trade before the open, and like magic the low was hit shortly after the open at exactly Black Box Forecasts is simply black magic, and I particularly admire your patience and discipline to only offer trades whose projected profits are four times greater than the money risked.

An axiom in every trading scheme is the importance of cutting losses. I shorted AOL, but covered when Black Box Forecasts predicted correctly it was headed at least 25 points higher.

Cutting my loss was painful but nothing like it would have been had I been forced to cover in the subsequent run-up. I am a believer! Retired Stanford professor and technical options trader Hidden Pivot strategies and analysis. We have really enjoyed your work. It is the consensus on our trading desks that it is important to have numbers that mean something instead of global ranges because our job is to make each desk profitable.

The only way to do that is by good, effective, money management and certainly your pivot and target areas are very helpful. I had never held an option right up to expiration before, but it was exciting and profitable.

Keep them coming, and thanks! Earl Degner Techncial options trader using Hidden Pivot strategies and analysis. Since I subscribed to Black Box Forecasts, it has hit nearly every important turning point with a degree of accuracy that puts other forecasters to shame. Your numbers are that good.

Morgan Professional technical options trader using Hidden Pivot strategies and analysis. Rick, you are a genius. Gold had one of its biggest swings today in 20 years, and you nailed both the exact high and low by within a total of less than one point. Technical options trader using Hidden Pivot strategies and analysis.

As per the site he was a market maker at the Pacific Coast Exchange for twelve years. There he helped FBI caught a rogue trader from Merrill Lynch. The trader stuffed rat poison in the containers of drugs from Smith-Kline and tipped news stations about the poisoned drugs supplied by the company.

When the news of poison laced drugs was aired, the share price tanked.

Frank Denneman

Rick smelled a rat and started enquiring if a substantial short bet against the share had been made before the news spread. When he came to know about the trader, he informed FBI and the trader was eventually caught. Now you can wonder why I mentioned the story. On the face of it, it looks simple and free of any marketing gimmick. When you enter the site, you will be greeted with some analytical material and a few free recommendations. The articles show his genuine understanding of macro-economic and political issues and their possible consequences.

His writings also show his ability to clearly articulate his views and keep the readers engaged. So the first impression is positive. The services on offer are daily newsletters and intraday tips along with detailed strategies. The best part is he provides all the advices, including entry and exit points, stop losses and regular updates.

He offers a two week free trial offer too. I found this expensive. But his recommendations work. So, if the course fee looks high, the normal subscription can be a cheaper substitute as ultimately you are working on his understanding of price trend and will end up with similar conclusion when using techniques taught by him. Over all the efforts look genuine as you have transparency. Also you will hardly find any negative review from anybody about rick. I think you will not feel disappointed, at least with the free trial.

KnotFlea — Alpha Judge Reviewer Technical options trader using Hidden Pivot strategies. What can I say? Mike Boschma Retail technical options trader Hidden Pivot strategies and analysis.

His dedication to subscribers is unsurpassed by any other charting service. Furthermore, he writers in a concise, unwavering manner that cannot be misconstrued. His commentary is a must for any macro investor. Al Grigoletto Professional technical options trader using Hidden Pivot strategies and analysis. The information gained was at best hit or miss. Then I came across Black Box Forecasts and became a subscriber. Using Black Box Forecasts as a trading tool has been very profitable.

I would recommend the newsletter to any active trader. Flood Retail technical options trader using Hidden Pivot strategies and analysis. I appreciate you sending me the last 3 days of your newsletter to sample.

After checking the results, it makes me more confident of the decision to subscribe to your newsletter. Your accuracy is unspeakable. Retail technical options trader using Hidden Pivot strategies. Black Box Forecasts has been the most accurate trading guide that I have used. By and far, it has outperformed all other services combined. I recommend it highly. One aspect which separates Rick from other market timers is his method of defining precise objectives for stocks as opposed to target ranges.

His long-term call on the Japanese Yen bear market was particularly accurate. The discipline that Rick applies to his approach allows him to set aside biases and focus on what his numbers are telling him. As a result, he tends to catch trends early, before they are recognized by the broader public. I give Rick Ackerman a high recommendation as a writer and a technical market analysis.

During the year that I was trading on the PSE floor, Black Box Forecasts called virtually every top and bottom of importance in my primary stock, Newbridge Networks. It was really like having a crystal ball. I have never seen forecasts so accurate anywhere else. Peter Napoli Market maker using Hidden Pivot stocks and options strategies and analysis.

I have subscribed to many market forecasters and, to be blunt, am down tens of thousands of dollars due to their advice. Then you came along with clear advice, tight stops and price forecasts that were accurate to within ticks. There is also your great sense of humor, which, blended with the recommendations, helps me achieve the confidence level I need to trade successfully.

Coombs Retail technical options trader using Hidden Pivot strategies and analysis. I used the newsletter to get an edge as an options market maker. Even major turning points have been called to within just a few ticks of where they actually occurred.

Steve Murr Former market maker using Hidden Pivot options strategies and analysis. Retail technical options trader using Hidden Pivot strategies and analysis. I am a very youthful 69 years old, with a Series 7 license, and had never traded options seriously until I signed on with Black Box Forecasts.

My experience before you resulted in a small loss overall, but so far all my positions from your recommendations are on the plus side. Joe Oliveto Retail technical options trader using Hidden Pivot strategies and analysis. Thanks for helping me do it without losing any sleep! Sam Cabahug Retail technical options trader using Hidden Pivot strategies and analysis.

John Pollock Retail technical options trader using Hidden Pivot strategies and analysis. I am one who, two days in a row, profited from your projection on the DJIA futures.

I greatly appreciate your turning points. Charles Bernhardt Retail technical options trader using Hidden Pivot strategies and analysis. William Jackson Retail technical options trader using Hidden Pivot strategies and analysis. I am a relatively new and already very satisfied subscriber. You have a subscriber for life. Benedict Woo Retail technical options trader using Hidden Pivot strategies and analysis. For your information, I have over 30 years of investment background as a research analysis, portfolio manager and market technician.

Gardner Retired investment advisor and technical options trader using Hidden Pivot strategies and analysis. I am a novice with little capita, and only able to trade puts and calls via Schwab. Thanks for helping to make it possible. MacLean Retail technical options trader using Hidden Pivot strategies and analysis. Rick, you are the man! I am and individual trader who has subscribed to your newsletter for two years.

I have made more money with Black Box Forecasts than with any other of the myriad of services I have used combined. Thank you very much! Michael Purdue Retail technical options trader using Hidden Pivot strategies and analysis and analysis.

Russell Bennett Retail technical options trader using Hidden Pivot strategies and analysis. I hope you keep yen futures on your list. While I have improvised and stayed with some positions longer than you have recommended, your coverage has been quite accurate. Bill Dabbs Retail technical options trader using Hidden Pivot strategies. Edwards Retail technical options trader using Hidden Pivot strategies and analysis. Congratulations on your new service! Karen Ramsey At-home technical options trader using Hidden Pivot strategies and analysis.

I and another P-Coast specialist are very impressed with your work. I am an American who lives in Bali and am presently in Singapore. I trade gold stocks, where things move fast. I have tried Schultz, Kern, Droke — and you are the best, pal.

Just good, straighforward info is what you provide. Jack Blaylock Gold-stock trader using Hidden Pivot strategies and analysis. I read you today and I really had to tell you that this is some top-notch analysis and writing. Thanks, and kudos on your new service. Click here for a help page needed as a Hidden Pivot Graduate. Click here for a special deal for graduates of the Hidden Pivot Course who want to stay on the cutting edge. Start Subscription Lost my password. The technique entails identifying ultra-low-risk trade set-ups on, say, the one-minute bar chart, and then initiating trades in places where competition tends to be thin.

The three-hour Hidden Pivot Course is offered live each month. The next webinar will be held on Tuesday, June Click below to register or get more information. Home About Chat Room Subscribe Website Help Contact Us Events Calendar Hidden Pivot Lounge. Stocks Breathe At the heart of the system is a simple observation — that stocks breathe in and out, and that for every zig in a chart there is a zag somewhere else that corresponds to it exactly.

How It Works How does the system work? This means that the B-C leg of the pattern above can itself be divided into an abcd structure, as follows: Trident is still available in book form from Windsor Publishing, but its rudiments can be encompassed in a single chart: An Obvious Weakness One obvious weakness of this system is that it limits itself to just a single entry point along the entire length and breadth of the ABCD pattern.

RoadRunr — Alpha Judge Reviewer Technical options trader using Hidden Pivot strategies and analysis As a retired CTA I have never seen anything as prescient as your Black Box Forecasts. Scott Reeves Retired options technical analyst An axiom in every trading scheme is the importance of cutting losses. Retired Stanford professor and technical options trader Hidden Pivot strategies and analysis We have really enjoyed your work.

Robert Stehlik Trading professionals, StarWorks Hi, Rick. Earl Degner Techncial options trader using Hidden Pivot strategies and analysis Since I subscribed to Black Box Forecasts, it has hit nearly every important turning point with a degree of accuracy that puts other forecasters to shame.

Morgan Professional technical options trader using Hidden Pivot strategies and analysis Rick, you are a genius.

Flood Retail technical options trader using Hidden Pivot strategies and analysis I appreciate you sending me the last 3 days of your newsletter to sample. Retail technical options trader using Hidden Pivot strategies Black Box Forecasts has been the most accurate trading guide that I have used. Martin Fiterman, Principal Protective Group Securities One aspect which separates Rick from other market timers is his method of defining precise objectives for stocks as opposed to target ranges.

Sean Lamb, Associate Porter Capital Management During the year that I was trading on the PSE floor, Black Box Forecasts called virtually every top and bottom of importance in my primary stock, Newbridge Networks. Peter Napoli Market maker using Hidden Pivot stocks and options strategies and analysis I have subscribed to many market forecasters and, to be blunt, am down tens of thousands of dollars due to their advice.

Steve Murr Former market maker using Hidden Pivot options strategies and analysis I enjoy your colorful commentary and disciplined trading approach very much. Retail technical options trader using Hidden Pivot strategies and analysis I am a very youthful 69 years old, with a Series 7 license, and had never traded options seriously until I signed on with Black Box Forecasts.

Sam Cabahug Retail technical options trader using Hidden Pivot strategies and analysis I am finally having fun with options and sleeping at night! Thanks for your help. John Pollock Retail technical options trader using Hidden Pivot strategies and analysis I am one who, two days in a row, profited from your projection on the DJIA futures.

William Jackson Retail technical options trader using Hidden Pivot strategies and analysis I am a relatively new and already very satisfied subscriber. Gardner Retired investment advisor and technical options trader using Hidden Pivot strategies and analysis Great call!

MacLean Retail technical options trader using Hidden Pivot strategies and analysis Rick, you are the man! Russell Bennett Retail technical options trader using Hidden Pivot strategies and analysis I hope you keep yen futures on your list.

Edwards Retail technical options trader using Hidden Pivot strategies and analysis Congratulations on your new service!

Hidden Pivot Graduate Help Page Click here for a help page needed as a Hidden Pivot Graduate. Keep Your Skills Current Click here for a special deal for graduates of the Hidden Pivot Course who want to stay on the cutting edge. Login User Name Password Start Subscription Lost my password. Ruminations Absence of Fear Is Reason to Fear Rebound Looks a Tad Too Ambitious An Unimpressive Rebound The Mother of All Unwinds Is Coming in T-Bonds A Precise Benchmark for Nasdaq Bulls and Bears Will Shorts Lose Their Cool Again?

Steep Plunge Quickly Recouped Is Hallmark of a Late-Stage Bull Nasdaq Looks Eager to Drag Stocks Higher The Yellow Flag Is Out High-Flyers Showing Fatigue. For technical support, billing or other questions Contact Rick's Picks Trading stocks, options and commodities can be very risky. Rick's Picks warnings and disclaimers Disclaimer This site is for information purposes only and should not be considered personalized investment advice or a solicitation to buy or sell any securities.

This material does not take into account the investors particular investment objectives, financial situations or needs, and is not intended as a recommendation of particular securities, financial instruments or strategies to any investors. Investments based upon options strategies can involve significant risk and may lose money.

Rick's Picks gives no express or implied warranties of any kind, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. In no event shall Rick's Picks be liable to any person or entity for any liability whatsoever or any direct, indirect, special or consequential damages in connection with or resulting from any use hereof.

Analytic services and products provided by Rick's Picks are the result of separate activities designed to preserve the independence and objectivity of each analytic process. Rick's Picks has established policies and procedures to maintain the confidentiality of non-public information received during each analytic process.

Investing in stocks, bonds, option, futures and other financial instruments involve risks and may not be suitable for everyone.

Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document are available at CBOE or from your broker. Copies are also available from the Chicago Board Options Exchange, S.

LaSalle Street, Chicago, IL The OCC Prospectus contains information on options issued by The Options Clearing Corporation. Copies of this document are available from The Options Clearing Corporation, S. LaSalle Street, 24th Floor, Chicago, IL or the Chicago Board Options Exchange, S.

The documents available discuss exchange-traded options issued by The Options Clearing Corporation and are intended for educational purposes. No statement in the documents should be construed as a recommendation to buy or sell a security or to provide investment advice.

Other important information regarding the content on this site: All stocks, bonds, mutual funds, options, futures and other financial instruments shown are examples only, meant for educational purposes. These are not recommendations to buy or sell any security.

Any pricing or potential profitability shown does not take into account your trade size, brokerage commissions or taxes which will affect actual investment returns. Investment examples and comments presented are solely those of the author, analysts, experts, or information source quoted. They do not represent the opinions of Rick's Picks on whether to buy, sell or hold shares of a particular stock or option.

Investors should be cautious about any and all stock, futures or option recommendations and should consider the source of any advice on stock, future or option selection.

Various factors, including personal, fund or corporate ownership, may influence or factor into an experts stock analysis or opinion. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision.

In addition, investors are advised that past stock, future or option performance is no guarantee of future price appreciation or depreciation. It is expected that the limited distribution of these reports to a relatively small number of investors will not materially affect the price of a stock, options or future.