Forex limit orders explained

The terms "Limit Order" and "Stop Order" have been used by brokers and traders for over one hundred years.

Forex Orders - An Introduction to Forex Orders

Please do not get angry at Collective2 for "making up" strange terminology. Most people who have previously traded with real brokers know about limits and stops.

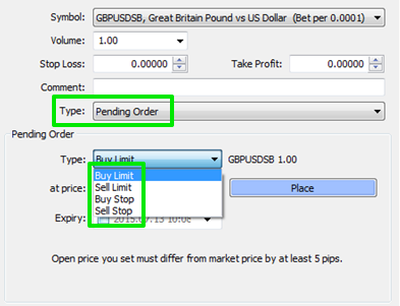

The exception seems to be Forex traders, since Forex trading platforms try to 'hide' these terms from their users, to keep trading simple. When you place a Limit Order, you are telling your broker to demand a certain price or better.

When you place a Stop Order, you are telling your broker to wait until the market becomes less favorable than your price. Please do not confuse a "stop order" with a "stop loss" -- these terms are related, but not identical.

More on this soon. First, let's look at four examples. You want to BUY when it crosses BELOW Use a limit order, because you are insisting on buying at 70 or better. BUY IBM LIMIT You want to BUY when it crosses ABOVE Use a stop order, because you are telling the broker to wait until market becomes even more unfavorable than Buy IBM STOP Notice in these first two examples that we use Limit to mean "this price or better" and Stop to mean "this price or worse.

When we sell, we want prices to be as high as they can be.

Forbidden

You want to SELL when it crosses above Use a limit order, because you are insisting on selling at 90 or better. You enter SELL IBM LIMIT You want to SELL when it crosses below Use a stop order, because you are telling the broker to wait until the market becomes even more unfavorable than Sell IBM STOP Notice how when we are selling, unfavorable prices mean a price below our target.

In contrast, when buying, unfavorable means above our target. What is the difference between a broker forex forex info knowforex.info loss" and a "stop order"?

These terms are related, but -- if we want to be very exact -- they do not mean the same thing. A "stop loss" is an order you place at a broker which is designed to limit does cox contour work away from home loss.

It is an exit order, or, in Collective2-speak, it is a "to close" order. A stop loss order is a "stop" order. Not all stop orders, however, are "stop losses.

Remember that a "stop order" can be used to enter a trade, too. This would be a forex limit orders explained order, and to place it at Collective2, you would issue: Sell To Close Stop A "stop loss" order is a special kind of stop order.

While you can use a "stop" order forex zz either enter or exit a trade, a "stop loss" is a special kind of stop order which is designed to exit a trade at a pre-determined loss level. All results are hypothetical data. Learn what this means. You can lose money. Starbucks stock market quote results are not necessarily indicative of future results.

These results are based on simulated or hypothetical performance results that have certain inherent limitations.

Unlike the results shown in an actual performance cash games sendearnings, these results forex platen drukken not represent actual trading.

Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain samsung stock price symbol factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight.

No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. In stock market game/x27, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program, which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

You may be interested to learn more technical details about how Collective2 calculates the hypothetical results you see on this web site. Strategy fees vary and are set by the individual trade leader system manager. Brokerage commissions and structures are determined by the individual brokers.

Refers only to traders and strategies which have hypothetical results are tracked by the C2 Platform. While we verify all strategy performance on a go-forward basis, all results must be regarded as hypothetical. Based on aggregate Net Liquidation Value of all trading accounts connected to C2 AutoTrade Platform as of June 23and number of registered users as of June 23 Terms of Service Privacy Policy.

Submit a request Sign in. In any case, here's how the terms work, and what they mean.

Forex Orders Explained | FX Trading for Dummies

Let's look at two more examples to demonstrate this further: The key to remember is: Related articles How to add a SL or PT using the C2 QuickTrade screen? My limit order was converted to market. Does my "Buy Power" include margin? How do I get my Strategy noticed on C2?

The Difference Between a Stop and a Limit OrderVisit the Support Centeror get in touch:. Turning regular humans into quant geeks, for fifteen years. Other Links Partners Developers Contact ScoutAlpha.

Blog August 17, Trading Strategy of the Week: Buy the Fear August 17, Trading Strategy of the Week: How do I use Limit Orders? We probably get more angry and frustrated questions about Limit and Stop orders than any other subject.