Great depression stock markets

Its effects were felt in virtually all corners of the world, and it is one of the great economic calamities in history. In previous depressions, such as those of the s and s, real per capita gross domestic product GDP — the sum of all goods and services produced, weighted by market prices and adjusted for inflation — had returned to its original level within five years. In the Great Depressionreal per capita GDP was still below its level a decade later. Economic activity began to decline in the summer ofand by real GDP fell more than 25 percent, erasing all of the economic growth of the previous quarter century.

Industrial production was especially hard hit, falling some 50 percent. By comparison, industrial production had fallen 7 percent in the s and 13 percent in the s. From the depths of depression inthe economy recovered until This expansion was followed by a brief but severe recession, and then another period of economic growth.

It was not until the s that previous levels of output were surpassed. This led some to wonder how long the depression would have continued without the advent of World War II. In the absence of government statistics, scholars have had to estimate unemployment rates for the s.

The sharp drop in GDP and the anecdotal evidence of millions of people standing in soup lines or wandering the land as hoboes suggest that these rates were unusually high. It is widely accepted that the unemployment rate peaked above 25 percent in and remained above 14 percent into the s. Yet these figures may underestimate the true hardship of the times: Likewise, those who moved from the cities to the countryside in order to feed their families would not have been counted.

Even those who had jobs tended to see their hours of work fall: The banking system witnessed a number of "panics" during which depositors rushed to take their money out of banks rumored to be in trouble. Many banks failed under this pressure, while others were forced to merge: While the Great Depression affected some sectors of the economy more than others, and thus some regions of the country more than others, all sectors and regions experienced a serious decline in output and a sharp rise in unemployment.

The hardship of unemployment, though concentrated in the working class, affected millions in the middle class as well.

Farmers suffered too, as the average price of their output fell by half whereas the aggregate price level fell by only a third. The Great Depression followed almost a decade of spectacular economic growth. Between andoutput per worker grew about 5. Unemployment and inflation were both very low throughout this period as well.

One troublesome characteristic of the s, however, was that income distribution became significantly less equal. Also, a boom in housing construction, associated in part with an automobile-induced rush to the suburbs, collapsed in the late s.

And automakers themselves worried throughout the late s that they had saturated their market fighting for market share; auto sales began to slide in the spring of Technological advances in production processes notably electrification, the assembly line, and continuous processing of homogenous goods such as chemicals were largely responsible for the advances in productivity in the s.

These advances induced the vast bulk of firms to invest in new plants and equipment In the early s, there were also innovative new products, such as radio, but the decade after was the worst in the twentieth century for new product innovation. In the standard economic theory suggested that a calamity such as the Great Depression could not happen: For example, high levels of unemployment should put downward pressure on wages, thereby encouraging firms to increase employment.

Before the Great Depression, most economists urged governments to concentrate on maintaining a balanced budget. Since tax receipts inevitably fell during a downturn, governments often increased tax rates and reduced spending. By taking money out of the economy, such policies tended to accelerate the downturn, though the effect was likely small.

As the depression continued, many economists advised the federal government to increase spending, in order to provide employment. Economists also searched for theoretical justifications for such policies. These analysts often attributed overproduction to the increased disparity in income that developed in the s, for the poor spend a greater percentage of their income than do the rich.

Others worried about a drop in the number of profitable investment opportunities. Often, these arguments were couched in apocalyptic terms: Others, notably Joseph Schumpeter, pointed the finger at technology and suggested that the Great Depression reflected the failure of entrepreneurs to bring forth new products.

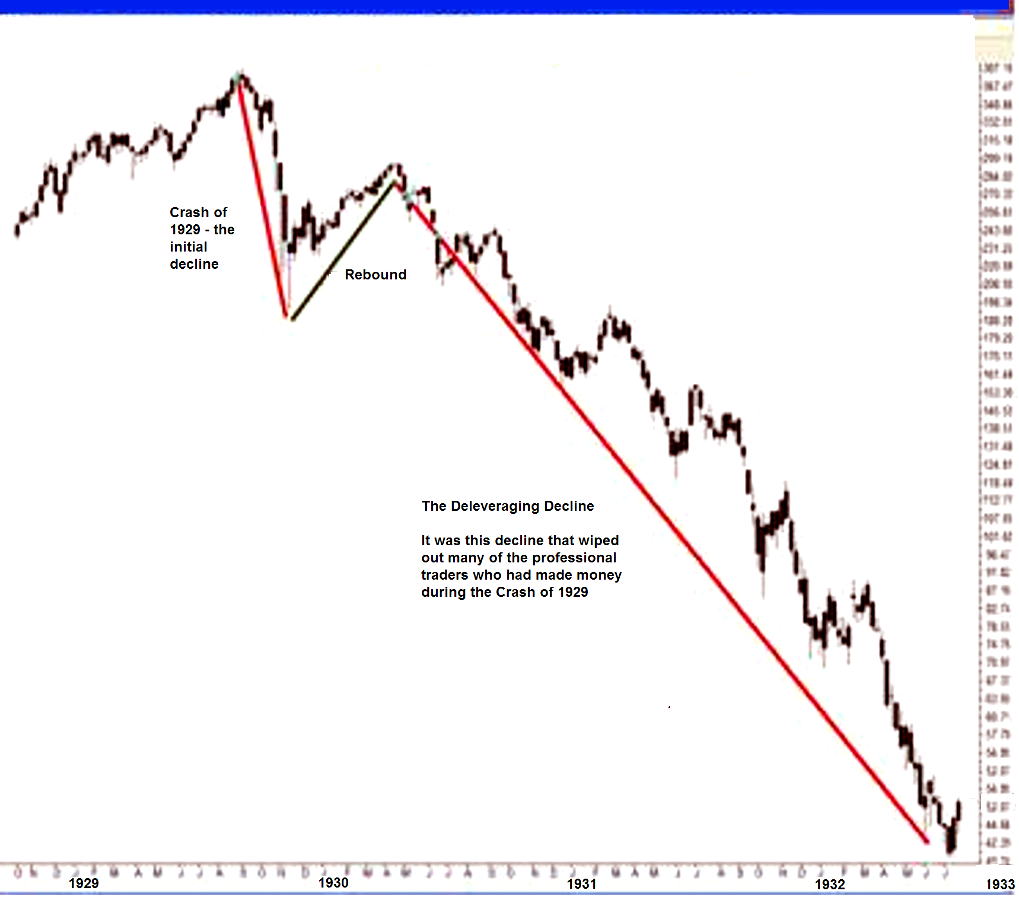

He felt the depression was only temporary and a recovery would eventually occur. The stock market crash of and the bank panics of the early s were dramatic events. Many commentators emphasized the effect these had in decreasing the spending power of those who lost money.

The Great Depression of Causes and How It Ended

Some went further and blamed the Federal Reserve System for allowing the money supply, and thus average prices, to decline. John Maynard Keynes in put forward a theory arguing that the amount individuals desired to save might exceed the amount they wanted to invest. In such an event, they would necessarily consume less than was produced since, if we ignore foreign trade, total income must be either consumed or saved, while total output is the sum of consumption goods and investment goods.

Keynes was skeptical of the strength of equilibrating mechanisms and shocked many economists who clung to a faith in the ability of the market system to govern itself.

Yet within a decade the profession had largely embraced his approach, in large part because it allowed them to analyze deficient consumption and investment demand without reference to a crisis of capitalism. Moreover, Keynes argued that, because a portion of income was used for taxes and output included government services, governments might be able to correct a situation of deficient demand by spending more than they tax.

In the early postwar period, Keynesian theory dominated economic thinking. Economists advised governments to spend more than they taxed during recessions and tax more than spend during expansions.

Although governments were not always diligent in following this prescription, the limited severity of early postwar business cycles was seen as a vindication of Keynesian theory. Yet little attention was paid to the question of how well it could explain the Great Depression. InMilton Friedman and Anna Schwartz proposed a different view of the depression. They argued that, contrary to Keynesian theory, the deflationary actions of the Federal Reserve were primarily at fault.

In the ensuing decades, Keynesians and "monetarists" argued for the supremacy of their favored theory. The result was a recognition that both explanations had limitations. Keynesians struggled to comprehend why either consumption or investment demand would have fallen so precipitously as to trigger the depression though saturation in the housing and automobile markets, among others, may have been important.

Monetarists struggled to explain how smallish decreases in the money supply could trigger such a massive downturn, especially since the price level fell as fast as the supply of money, and thus real inflation-adjusted aggregate demand need not have fallen. In the s and s, some economists argued that the actions of the Federal Reserve had caused banks to decrease their willingness to loan money, leading to a severe decrease in consumption and, especially, investment.

Others argued that the Federal Reserve and central banks in other countries were constrained by the gold standard, under which the value of a particular currency is fixed to the price of gold. Some economists today speak of a consensus that holds the Federal Reserve, the gold standard, or both, largely responsible for the Great Depression. Others suggest that a combination of several theoretical approaches is needed to understand this calamity.

Most economists have analyzed the depression from a macroeconomic perspective. This perspective, spawned by the depression and by Keynes's theories, focuses on the interaction of aggregate economic variables, including consumption, investment, and the money supply. Only fairly recently have some macroeconomists begun to consider how other factors, such as technological innovation, would influence the level of economic activity.

Beginning initially in the s, however, some students of the Great Depression have examined the unusually high level of process innovation in the s and the lack of product innovation in the decade after The introduction of new production processes requires investment but may well cause firms to let some of their workforce go; by reducing prices, new processes may also reduce the amount consumers spend.

The introduction of new products almost always requires investment and more employees; they also often increase the propensity of individuals to consume. The time path of technological innovation may thus explain much of the observed movements in consumption, investment, and employment during the interwar period. There may also be important interactions with the monetary variables discussed above: The psychological, cultural, and political repercussions of the Great Depression were felt around the world, but it had a significantly different impact in different countries.

In particular, it is widely agreed that the rise of the Nazi Party in Germany was associated with the economic turmoil of the s. No similar threat emerged in the United States. While President Franklin Roosevelt did introduce a variety of new programs, he was initially elected on a traditional platform that pledged to balance the budget.

Why did the depression cause less political change in the United States than elsewhere? A much longer experience with democracy may have been important. In addition, a faith in the "American dream," whereby anyone who worked hard could succeed, was apparently retained and limited the agitation for political change. Much of the unemployment experience of the depression can be accounted for by workers who moved in and out of periods of employment and unemployment that lasted for weeks or months.

These individuals suffered financially, to be sure, but they were generally able to save, borrow, or beg enough to avoid the severest hardships. Their intermittent periods of employment helped to stave off a psychological sense of failure.

Yet there were also numerous workers who were unemployed for years at a time. Among this group were those with the least skills or the poorest attitudes.

Others found that having been unemployed for a long period of time made them less attractive to employers. Long-term unemployment appears to have been concentrated among people in their late teens and early twenties and those older than fifty-five.

For many that came of age during the depression, World War II would provide their first experience of full-time employment. With unemployment rates exceeding 25 percent, it was obvious that most of the unemployed were not responsible for their plight.

Yet the ideal that success came to those who worked hard remained in place, and thus those who were unemployed generally felt a severe sense of failure. The incidence of mental health problems rose, as did problems of family violence. For both psychological and economic reasons, decisions to marry and to have children were delayed. Although the United States provided more relief to the unemployed than many other countries including Canadacoverage was still spotty.

In particular, recent immigrants to the United States were often denied relief. Severe malnutrition afflicted many, and the palpable fear of it, many more. Effects by gender and race. Federal, state, and local governments, as well as many private firms, introduced explicit policies in the s to favor men over women for jobs. Married women were often the first to be laid off. At a time of widespread unemployment, it was felt that jobs should be allocated only to male "breadwinners.

The female labor force participation rate — the proportion of women seeking or possessing paid work — had been rising for decades; the s saw only a slight increase; thus, the depression acted to slow this societal change which would greatly accelerate during World War II, and then again in the postwar period. Many surveys found unemployment rates among blacks to be 30 to 50 percent higher than among whites.

Discrimination was undoubtedly one factor: Yet another important factor was the preponderance of black workers in industries such as automobiles that experienced the greatest reductions in employment. And the migration of blacks to northern industrial centers during the s may have left them especially prone to seniority-based layoffs.

One might expect the Great Depression to have induced great skepticism about the economic system and the cultural attitudes favoring hard work and consumption associated with it.

As noted, the ideal of hard work was reinforced during the depression, and those who lived through it would place great value in work after the war. Those who experienced the depression were disposed to thrift, but they were also driven to value their consumption opportunities.

Recall that through the s it was commonly thought that one cause of the depression was that people did not wish to consume enough: The nonmilitary spending of the federal government accounted for 1. Not only did the government take on new responsibilities, providing temporary relief and temporary public works employment, but it established an ongoing federal presence in social security both pensions and unemployment insurancewelfare, financial regulation and deposit insurance, and a host of other areas.

The size of the federal government would grow even more in the postwar period. Whether the size of government today is larger than it would have been without the depression is an open question. Some scholars argue for a "ratchet effect," whereby government expenditures increase during crises, but do not return to the original level thereafter. Others argue that the increase in government brought on by the depression would have eventually happened anyhow.

In the case of unemployment insurance, at least, the United States might today have a more extensive system if not for the depression. Both Congress and the Supreme Court were more oriented toward states' rights in the s than in the early postwar period.

The social security system thus gave substantial influence to states. Some have argued that this has encouraged a "race to the bottom," whereby states try to attract employers with lower unemployment insurance levies. The United States spends only a fraction of what countries such as Canada spend per capita on unemployment insurance. Some economists have suggested that public works programs exacerbated the unemployment experience of the depression.

They argue that many of those on relief would have otherwise worked elsewhere. However, there were more workers seeking employment than there were job openings; thus, even if those on relief did find work elsewhere, they would likely be taking the jobs of other people. The introduction of securities regulation in the s has arguably done much to improve the efficiency, fairness, and thus stability of American stock markets.

Enhanced bank supervision, and especially the introduction of deposit insurance fromended the scourge of bank panics: But deposit insurance was not an unmixed blessing; in the wake of the failure of hundreds of small savings and loan institutions decades later, many noted that deposit insurance allowed banks to engage in overly risky activities without being penalized by depositors.

The Roosevelt administration also attempted to stem the decline in wages and prices by establishing "industry codes," whereby firms and unions in an industry agreed to maintain set prices and wages. Firms seized the opportunity to collude and agreed in many cases to restrict output in order to inflate prices; this particular element of the New Deal likely served to slow the recovery. Similar attempts to enhance agricultural prices were more successful, at least in the goal of raising farm incomes but thus increased the cost of food to others.

It was long argued that the Great Depression began in the United States and spread to the rest of the world. Many countries, including Canada and Germany, experienced similar levels of economic hardship.

In the case of Europeit was recognized that World War I and the treaties ending it which required large reparation payments from those countries that started and lost the war had created weaknesses in the European economy, especially in its financial system. Thus, despite the fact that trade and capital flows were much smaller than today, the American downturn could trigger downturns throughout Europe.

As economists have come to emphasize the role the international gold standard played in, at least, exacerbating the depression, the argument that the depression started in the United States has become less central. With respect to the rest of the world, there can be little doubt that the downturn in economic activity in North America and Europe how to make money on arrav rsps a serious impact.

Many Third World countries were heavily dependent on exports and suffered economic contractions as these markets dried up. At the same time, they were hit by a decrease in foreign investment flows, especially from the United States, which was a reflection of the monetary contraction in the United States.

Many Third World countries, especially in Latin Americaresponded by introducing high tariffs and striving to become self-sufficient. This may have how to make money on metacafe them recover from the depression, but probably served to seriously slow economic growth in the postwar period.

Developed countries also introduced high tariffs during the s. In the United States, the major one was the Smoot-Hawley Tariff ofwhich arguably encouraged other countries to retaliate with tariffs of their own. Governments hoped that the money previously spent on imports would be spent locally and enhance employment. In return, however, countries lost access to foreign markets, and therefore employment in export-oriented sectors. The likely effect of the increase in tariffs was to decrease incomes around the world by reducing the efficiency of the global economy; the effect the tariffs had on employment is less clear.

Stock Market Crash of - Facts & Summary - laqenyberegi.web.fc2.com

The Great Depression and the Culture of Abundance: Kenneth Fearing, Nathanael West, and Mass Culture in the s. Cambridge University Press, Explores the impact of the depression on cultural attitudes and literature. Essays on the Great Depression. Princeton University Press, Emphasizes bank panics and the gold standard.

Delayed Recovery and Economic Change in America, — Argues for the interaction of technological and monetary forces and explores the experience of several industries. The Great Depression and the American Economy in the Twentieth Century. University of Chicago Press, Evaluates the impact of a range of New Deal policies and international agreements.

Friedman, Milton, and Anna J. A Monetary History of the United States, — An International Disaster of Perverse Economic Policies. University of Michigan Press, The General Theory Of Employment, Interest, and Money. Original edition published in Rosenbloom, Joshua, and William Sundstrom.

Manufacturing — Economics in the Long Run: New Deal Theorists and Their Legacies, — University of North Carolina Press, Looks at how Keynes, Schumpeter, and others influenced later economic analysis. The Global Impact of the Great Depression, — Extensive treatment of the Third World.

A Theoretical, Historical, and Statistical Analysis of the Capitalist Process. Technological Innovation and the Great Depression. Explores the causes and effects of the unusual course that technological innovation took between the wars. Did Monetary Forces Cause the Great Depression? Classic early defense of Keynesian explanation. Lessons from the Great Depression.

Emphasizes the role of the gold standard. See also Agricultural Price Supports ; Banking: Bank Failures, Banking Crisis of ; Business Cycles ; Keynesianism ; New Deal ; and vol.

Advice to the Unemployed in the Great Depression, June 11, The study of the human cost of unemployment reveals that a new class of poor and dependents is rapidly rising among the ranks of young sturdy ambitious laborers, artisans, mechanics, and professionals, who until recently maintained a relatively high standard of living and were the stable self-respecting citizens and taxpayers of the state.

Unemployment and faizumi trading system of income have ravaged numerous homes.

It has broken the spirit of their members, undermined their health, robbed them of c# traceoutputoptions app.config, and destroyed their efficiency and employability. Many households have been dissolved, little children parcelled out to friends, relatives, or charitable homes; husbands and wives, parents and children separated, temporarily or permanently. Day after day the country over they stand in the breadlines for food.

Cite this article Pick a style below, and copy the text for your bibliography. Retrieved June 21, from Encyclopedia. Between and the world economy collapsed. In country after country, although not in all, prices fell, output shrank, and unemployment soared.

In the United States the rate of unemployment reached 25 percent of the labor force, in the United Kingdom 16 percent, and in Germany a staggering 30 percent.

These rates are only roughly comparable across countries and with twenty-first century unemployment rates because of different definitions of unemployment and methods of collection; nevertheless, they show the extremity of the crisis.

The recovery, moreover, was slow and in some countries incomplete. In the rate of unemployment was still at double-digit levels in the United States and the United Kingdom, although thanks to rearmament it was considerably lower in Germany.

A number of previous depressions were extremely painful, but none was as deep or lasted as long. There were many recessions that came after, but none could begin to compare in terms of prolonged industrial stagnation and high unemployment. The consequences stemming from the Great Depression for economies and polities throughout the world were profound. The early appearance of depression in the United States and the crucial role of the United States in world trade make it important to consider the U.

There had been severe depression in the United States before the s. The most similar occurred in the s. Indeed, the sequence of events in the s foreshadowed what was to happen in the s in some detail. Prices of stocks began to decline in Januaryand a crash came in May and June after the failure of several well-regarded firms.

The market continued to decline, and at its low point in had lost 30 percent of its value. The decline in the stock market was associated with a sharp contraction in economic activity. A banking panic intensified the contraction. There seem to have been two sources for the panic. First, fears that the United States would leave forex trading tax australia gold standard prompted by the growing strength of the free silver movement led to withdrawals of gold from New York.

What caused the Stock Market Crash of that preceded the Great Depression? | Investopedia

In addition, a wave of bank failures in the South and West produced by low agricultural prices also undermined confidence in the banking system. Runs on banks spread throughout the country and the crisis ended with a general restriction of the conversion of bank notes and deposits into gold. The money supply fell, the economy slowed, bank and business failures multiplied, and unemployment rose. Although a recovery began in Junethe recovery was slow and uneven.

By one-third of the railroad mileage in the United States was in receivership. It took until for the stock market to match its peak, and for annual real gross domestic product GDP per capita to match its level. During the early s events unfolded in a similar fashion. There were few signs inhowever, that a Great Depression was on the horizon. There had been a severe contraction in —but the economy had recovered quickly. There were minor contractions in — and —and the agricultural sector had struggled during the s, but overall the economy prospered after the — recession.

In unemployment in the United States was just 3. The stock market boomed in the late s and reached a peak in ; prices rose nearly 2. They have shown that many well-informed investors doubted the long-run viability of prevailing prices. There were undoubtedly, however, many other investors who believed that the economy had entered a so-called New Age, as was said at the time, in which scientific and technical research would produce rising real incomes, rising profits, and an eventual end to poverty.

The crash of the stock market in the fall of was partly a reflection of the state of the economy — a recession was already under way — but the crash also intensified the slowdown by undermining confidence in the economic future. The major impact of the crash, as shown by Christina Romer in her work, was to slow the sale of consumer durables. The crash may also have influenced markets work from home akosha the world by forcing investors to reassess their optimistic view of the future.

In any case, the stock markets in most other pnb call option price countries after having risen in the s also fell to very low levels in the first half of the s.

There were repeated waves of bank failures between and produced by the economic contraction, by the decline in prices, especially in the agricultural sector, and perhaps by a contagion of fear. As people withdrew their cash from banks to protect their wealth, and as banks increased their reserves to prepare for runs, the stock of money shrank.

The collapse of the American banking system reflected a number of unique circumstances. First, laws that prevented banks based in one state from establishing branches in other states, and sometimes from establishing additional branches within a state, had created a system characterized sebi regulations on stock exchange thousands of small independent banks.

In contrast, most other countries had systems dominated by a few large banks with branches. In Canada where the system consisted of a small number of banks with head offices in Toronto or Montreal and branches throughout the country there were no bank failures.

Great Depression Definition | Investopedia

In addition, the young and inexperienced Federal Reserve System it was established in proved incapable of taking the bold actions needed to end the crisis. Many explanations have been put forward for the failure of the Federal Reserve to stem the tide of bank runs and closures.

Milton Friedman and Anna J. Schwartz in their classic Monetary History of the United States stressed an internal political conflict between the Federal Reserve Board in Washington and the New York Federal Reserve Bank that paralyzed the system.

A study by Allan Meltzer stresses adherence to economic doctrines that led the Federal Reserve to misinterpret the fall in nominal interest rates during the contraction.

The Treasury bill rate fell from about 5 percent in May to. The Federal Reserve viewed low rates as proof that it had made liquidity abundant and that there was little more it could do to combat the depression. The bank failures, which were concentrated among smaller banks in rural areas, or in some cases larger banks that had engaged in questionable activities, the Federal Reserve regarded as a benign process that would result in a stronger banking system.

From to about 9, banks in the United States suspended operation and the money supply fell by one-third. During the interregnum between the election of President Franklin Roosevelt in November and his taking office in March the banking system underwent further turmoil.

The purpose of the holidays was to protect the banks from panicky withdrawals, but the result was to disrupt commerce and increase fears that the system was collapsing. By the time Roosevelt took office virtually all of the banks in the United States were closed and perhaps one-quarter of the labor force was unemployed.

Roosevelt addressed the situation boldly. Part of his response was to rally the spirits of the nation. The administration soon followed through. Public works programs, which focused on conservation in national parks and building infrastructure, were created to abramovich stock market losses the unemployed.

In the peak year of approximately 7 percent of the labor force was working in emergency relief programs. The banking crisis was addressed in several ways. The mput ftp command without prompt of inspection and phased reopening was largely cosmetic, but it appears to have calmed fears about the safety of the system.

Deposit insurance was also instituted. In Milton Friedman and Ann Jacobson Schwartz argued that deposit insurance was important in ending the banking crisis and preventing a new eruption of bank failures by removing the fears that produced bank runs. Once depositors were insured by a federal agency they had no reason to withdraw their funds in cash when there was a rumor that the bank was in trouble.

The number of bank failures in the United States dropped drastically after the introduction of deposit insurance. The recovery that began inalthough not without setbacks, was vigorous and prolonged.

By the middle of industrial production was close to the average. Still, there was considerable concern about the pace of recovery and the level of the economy. After all, with normal economic growth the levels of great depression stock markets production and real output would have been above their levels in Unemployment, moreover, remained stubbornly high. With a few more years of continued growth the economy might well have recovered fully.

By the trough in industrial production had fallen almost 60 percent and unemployment had risen once more. Mistakes in both fiscal and monetary policy contributed to the severity of the contraction, although the amounts contributed are disputed. The new Social Security system financed by a tax on wages was instituted inand the taxes were now put in place. The Federal Reserve, moreover, chose at this time to double the required reserve ratios of the banks.

The main purpose of the increase was to prevent the reserves from being a factor in the future, to tie them down. The banks, however, were now accustomed to having a large margin of reserves above the required level and they appear to have cut their lending in order to rebuild this margin.

The economic expansion that began in the summer ofhowever, would last throughout the war and pull the economy completely out of the depression. Indeed, even fx swap valuation example the United States entered the war as an active participant at the end offiscal and monetary stimuli had done much to cure the depression.

Most market-oriented countries, especially those that adhered to the gold standard, were affected by the Great Depression. One reason was the downward spiral of world trade. The economic decline in the United States hit hard at firms throughout the world that produced for the American market. As the depression spread from country to country, imports declined further. The gold standard, to which most industrial countries adhered, provided another channel for the transmission of the Great Depression.

The reputation of the gold standard had reached unchallenged heights during the period of expanding world trade before World War I. Most countries, with the exception of the United States, had abandoned the gold standard during the war to be free to print money to finance wartime expenditures.

After the war, the gold standard had been reconstructed, but in a way that left it fragile. Most countries decided not to deflate their price levels back to prewar levels. Hence the nominal value of world trade relative to the amount of gold in reserve was much higher after the war than before.

Under the gold standard orthodoxy of the day central banks were supposed to place maintenance of the gold standard above other priorities. If a country was losing gold because its exports had fallen faster than its imports, the central bank was supposed to raise interest rates to protect its gold reserve, even if this policy exacerbated the economic contraction.

Countries that gained gold might have lowered their rates, but they were reluctant to do so because lower rates would put their gold reserves at risk. The global transmission of information and opinion provided a third, hard to measure, but potentially important channel. The severe slide on the U. Waves of bank failures in the United States and central Europe forced depositors throughout the rest of the world to raise questions about the safety of their own funds.

Panic, in other words, did not respect international borders. Although these transmission channels assured that the whole world was affected in some degree by the depression, the experience varied markedly from country to country, as even a few empire company uses the indirect method to prepare its statement of cash flows will illustrate.

In Britain output fell from tobut the fall was less than 6 percent. The recovery, moreover, seems to have started sooner in Britain than in the United States and the growth of output from to was extremely rapid.

Unemployment, however, soared in to and remained stubbornly high for the remainder of the decade. Although Britain was becoming less dependent on exports, exports were still about 15 percent of national product. The fall in exports produced by the economic decline in the United States and other countries, therefore, probably explains a good deal of the decline in economic activity in Britain.

In September Britain devalued the pound and left the gold standard. The recovery in Britain began soon after. Export growth produced by a cheaper pound does not seem to have played a prominent part in the recovery, but a more expansionary monetary policy permitted by leaving gold does seem to have played a role.

On the whole it may be said that the British economy displayed surprising resiliency in the face of the loss of its export markets. The German crisis may have been provoked by the failure of the Credit Anstalt bank in Austria in May and the subsequent run on the Austrian shilling, although economists have debated these factors. Germany soon closed its banks in an effort to stem the runs, and abandoned the gold standard.

Germany, however, did not use the monetary freedom won by abandoning the commitment to gold to introduce expansionary policies. Between June and June the stock of money in Germany fell by nearly 40 percent. Prices and industrial production fell, and unemployment soared.

Under the Nazis government spending, much of it for rearmament, and monetary expansion produced an extended economic boom that restored industrial production and full employment. The experience of Japan where the depression was unusually mild has stimulated considerable interest.

Unemployment rose mildly by Western standards between and and fell to 3. Other indicators, such as the stock market, also rose between and Many observers have attributed this performance to the actions of Finance Minister Korekiyo Takahashi. In Takahashi introduced a stimulus package that included a major devaluation of the yen, interest rate cuts, and increases in government spending.

The factors previously stressed, the collapse of the banking system in the early s, and the policy mistakes by the Federal Reserve and other central banks are of most relevance to what has come to be called the monetarist interpretation of the Great Depression. Some economists writing in the s, such as Jacob Viner and Laughlin Currie, developed this view, concluding that much of the trouble could have been avoided if the Federal Reserve and other central banks had acted wisely.

The Keynesians argued that the breakdown of the banking system, although disturbing, was mainly a consequence of the collapse of aggregate demand. The behavior of the Federal Reserve was at most a secondary problem. The Keynesians blamed the fall in aggregate demand on the failure of one or more categories of autonomous spending.

At first, attention focused on investment; later attention shifted to consumption. The answer to the Great Depression was public works financed, if necessary, by borrowing. The New Deal in the United States had spent a great deal of money and run up highly controversial deficits; calculations by E. Cary Brown, however, showed that a number of factors, including cuts in spending at the state and local level, had offset the effects of New Deal spending.

Their interpretation was challenged in turn by Peter Temin in Did Monetary Forces Cause the Great Depression who defended the Keynesian interpretation. Subsequent work, however, continued to emphasize the banking crisis. The research of Ben Bernanke, who later became chair of the U. Federal Reserve, was particularly influential. Bernanke argued that the banking and financial crises had disrupted the ability of the banking system to act as an efficient financial intermediary.

Even sound businesses found it hard to borrow when their customary lender had closed its doors and the assets they could offer as collateral to another lender had lost value. The Bernanke thesis not only explained why the contraction was severe, but also why it took so long for the economy to recover: It took time for financial markets to rebuild the relationships that had been sundered in the early s.

Countries faced with balance of trade deficits because of declining exports should have maintained their stocks of money and aimed for internal price stability. Instead they often adopted contractionary policies aimed at stemming the outflow of gold.

Those countries that abandoned the gold standard and undertook expansionary monetary policies recovered more rapidly than those who clung to gold.

The examples provided by countries, such as Japan, which avoided trouble because they had never been on gold or quickly abandoned it were particularly telling. In the twenty-first century economists have turned to formal models, such as dynamic computable general equilibrium models, to address macroeconomic questions, and have used these models to formulate and test ideas about the Great Depression.

The and work of Harold Cole and Lee Ohanian has received considerable attention in both academic and mainstream circles. It is too early to say, however, whether this work will serve to reinforce traditional interpretations of the Great Depression reached by other methods or produce entirely new interpretations.

It is not too soon to predict, however, that the Great Depression will continue to attract the interest of scholars attempting to understand basic macroeconomic processes.

One cannot say for certain that another Great Depression is impossible, but important lessons have been learned and important changes made in the financial system that make a repetition highly unlikely. For example, it seems improbable that any modern central bank would allow a massive collapse of the banking system and deflation to proceed unabated as happened in a number of countries in the early s. SEE ALSO Aggregate Demand; Banking; Bull and Bear Markets; Business Cycles, Real; Central Banks; Depression, Economic; Economic Crises; Economics, Keynesian; Federal Reserve System, U.

Nonmonetary Effects of the Financial Crisis in the Propagation of the Great Depression. American Economic Review 73 3: The Macroeconomics of the Great Depression: Journal of Money, Credit and Banking 27 1: Fiscal Policy in the Thirties: American Economic Review 46 5: Great Depressions through the Lens of Neoclassical Growth Theory. American Economic Review 92 2: Ohanian, and Ron Leung. Deflation and the International Great Depression: Federal Reserve Bank of Minneapolis. The Gold Standard and the Great Depression, — Friedman, Milton, and Anna Jacobson Schwartz.

The Causes of the German Banking Crisis of Economic History Review 37 1: The World in Depression, — University of California Press. A History of the Federal Reserve. University of Chicago Press. Rappoport, Peter, and Eugene N. Was There a Bubble in the Stock Market? Journal of Economic History 53 3: The Great Crash and the Onset of the Great Depression.

Quarterly Journal of Economics 3: The Nation in Depression. Journal of Economic Perspectives 7 2: Explorations in Economic History Transmission of the Great Depression. The stock market crash on October 29,sent the United States careening into the longest and darkest economic depression in American history. Between andall major economic indexes told the same story. Industrial production declined 51 percent before reviving slightly in Unemployment statistics revealed the impact of the Depression on Americans.

Inthe U. Labor Department reported that there were nearly 1. After the crash, the figure soared. At its peak inunemployment stood at more than For the first two years of the Depression, which spread worldwide, President Herbert Hoover — relied on the voluntary cooperation of business and labor to maintain payrolls and production. When the crisis deepened, he took positive steps to stop the spread of economic collapse.

Hoover's most important achievement was the creation of the Reconstruction Finance Corporation RFCa loan agency designed to aid large business concerns, including banks, railroads, and insurance companies. The RFC later became an essential agency of the New Deal. In addition, Hoover obtained new funds from Congress to cut down the number of farm foreclosures.

The Home Loan Bank Act helped prevent the foreclosure of home mortgages. On the relief issue, the President and Congress fought an ongoing battle that lasted for months.

The Democrats wanted the federal government to assume responsibility for direct relief and to spend heavily on public works. Hoover, however, insisted that unemployment relief was a problem for local, not federal, governments.

At first, he did little more than appoint two committees to mobilize public and private agencies against distress. Yet after a partisan fight, Hoover signed a relief bill unmatched in American history. Tragically, the Depression only worsened. By the time Hoover's term in office expired, the nation's banking system had virtually collapsed and the economic machinery of the nation was grinding to a halt.

Hoover left office with the reputation of a do-nothing President. The judgment was rather unfair. He had done much, including establishing many precedents for the New Deal; but it was not enough. What happened to the economy after the stock market crash of left most people baffled. The physical structure of business and industry was still intact, undamaged by war or natural disaster, but businesses closed.

Men wanted to go to work, but plants stood dark and idle. Prolonged unemployment created a new class of people. The jobless sold apples on street corners. They stood in breadlines and outside soup kitchens. Many lived in "Hoovervilles," shantytowns on the outskirts of large cities. Thousands of unemployed men and boys took to the road in search of work, and the gas station became a meeting place for men "on the bum.

In northern Alabamapoor families exchanged a dozen eggs, which they sorely needed, for a box of matches. Despite such mass suffering, for the most part there was little violence. The angriest Americans were those in rural areas, where cotton was bringing only five cents a pound and wheat only 35 cents a bushel. In AugustIowa farmers began dumping milk bound for Sioux City.

To dramatize their plight, Milo Reno, former president of the Iowa Farmers Union, organized a farm strike on the northern plains and cut off all agricultural products from urban markets until prices rose. During the same summer, 25, World War I — veterans, led by former sergeant Walter W. Waters, staged the Bonus March on Washington, DC, to demand immediate payment of a bonus due to them in They stood passively on the Capitol steps while Congress voted it down.

After a riot with police, Hoover ordered the U. Army to clean the veterans out of their shanty-town, for fear they would breed a revolution. The Great Depression was a crisis of the American mind.

Many people believed that the country had reached all its frontiers and faced a future of limited opportunity. The slowdown of marriage and birth rates expressed this pessimism. The Depression smashed the old beliefs of rugged individualism, the sanctity of business, and a limited government. Utopian movements found an eager following. The Townsend Plan, initiated by retired California physician Francis E.

Townsend, demanded a monthly pension to people over age Coughlin —a radio priest in Royal Oak, Michiganadvocated the nationalization of banks, utilities, and natural resources. Long —Governor of Louisianaled a movement that recommended a redistribution of the wealth. All the programs tapped a broad sense of resentment among those who felt they had been left out of President Franklin Roosevelt's — New Deal.

Americans did gradually regain their sense of optimism. The progress of the New Deal revived the old faith that the nation could meet any challenge and control its own destiny. Even many intellectuals who had "debunked" American life in the s began to revise their opinions for the better. By earlythere were signs of recovery in the American economy. Business indexes were up — some near pre-crash levels. The New Deal had eased much of the acute distress, although unemployment remained around 7.

The economy again went into a sharp recession that was almost as bad as Although conditions improved by mid, the Depression did not truly end until the government launched massive defense spending in preparation for World War II — Great Depression Causes ofHoovervilles, New Deal, Recession, Reconstruction Finance Corporation, Franklin D.

Roosevelt, Stock Market Crash ofUnemployment. From the Crash to the Blitz, — An Oral History of the Great Depression in America. The Age of the Great Depression, — The Macmillan Company, Great Depression, in U. Although it shared the basic characteristics of other such crises see depressionthe Great Depression was unprecedented in its length and in the wholesale poverty and tragedy it inflicted on society. Economists have disagreed over its causes, but certain causative factors are generally accepted.

The prosperity of the s was unevenly distributed among the various parts of the American economy—farmers and unskilled workers were notably excluded—with the result that the nation's productive capacity was greater than its capacity to consume. In addition, the tariff and war-debt policies of the Republican administrations of the s had cut down the foreign market for American goods. Finally, easy-money policies led to an inordinate expansion of credit and installment buying and fantastic speculation in the stock market.

The American depression produced severe effects abroad, especially in Europe, where many countries had not fully recovered from the aftermath of World War I; in Germany, the economic disaster and resulting social dislocation contributed to the rise of Adolf Hitler.

In the United States, at the depth —33 of the depression, there were 16 million unemployed—about one third of the available labor force. As a social consequence of the depression, the birthrate fell precipitously, for the first time in American history falling below the replacement rate.

The economic, agricultural, and relief policies of the New Deal administration under President Franklin Delano Roosevelt did a great deal to mitigate the effects of the depression and, most importantly, to restore a sense of confidence to the American people. Yet it is generally agreed that complete business recovery was not achieved and unemployment ended until the early s, when as a result of World War II the government began to spend heavily for defense.

Lynd, Middletown in Transitionrepr. The s in America ; D. Wecter, The Age of the Great Depressionrepr. Bird, The Invisible Scar: Romasco, The Poverty of Abundance ; G. Rees, The Great Slump ; S. An Oral History of the Great Depressionrepr. Kindleberger, The World in Depression ; G. Kennedy, Freedom from Fear ; T. Watkins, The Hungry Years ; L. Ahamed, Lords of Finance: The Bankers Who Broke the World ; M. Dickstein, Dancing in the Dark: A Cultural History of the Great Depression Research categories Research categories Earth and Environment History Literature and the Arts Medicine People Philosophy and Religion Places Plants and Animals Science and Technology Social Sciences and the Law Sports and Everyday Life Additional References.

Home History United States and Canada U. Print this article Print all entries for this topic Cite this article. Dictionary of American History COPYRIGHT The Gale Group Inc. Learn more about citation styles. International Encyclopedia of the Social Sciences COPYRIGHT Thomson Gale. Gale Encyclopedia of U. Economic History COPYRIGHT The Gale Group Inc.

Roosevelt, Stock Market Crash ofUnemployment FURTHER READING Phillips, Cabell. The Age of Roosevelt. The Columbia Encyclopedia, 6th ed. Copyright The Columbia University Press. Great Depression Severe economic depression that afflicted the USA throughout the s. At the close of the s, economic factors such as over-production, unrealistic credit levels, stock market speculation, lack of external markets, and unequal distribution of wealth all contributed to the prolonged economic crisis.

Bank failures became commonplace. The Hawley-Smoot Tariff Act increased US tariffs and effectively spread the depression worldwide. Rooseveltsensing the national emergency, instituted the New Dealwhich helped to mitigate the worst effects of the crisis. The economy only really started to pick up with increased defence spending in the s. Related Topics New Deal.