Flipper trading system

You are using an out of date browser. It may not display this or other websites correctly. You should upgrade or use an alternative browser. Discussion in ' Technical Analysis ' started by Turok , Feb 2, Log in or Sign up.

And there is no risk! You are always "with the market". I will present a spreadsheet with the trade results at the end of this fairly long post s which will attempt to explain certain decisions I made during coding.

The data was scrubbed of erroneous or irrelevant ticks by removing any record that fell more than 0. First let it be said that I am actively seeking comments on where I went wrong. Expect me to concede when you have a point and expect me to resist if I feel that you do not. In my experience I am neither a newbie nor a Livermore good trading systems end up making sense and trading logic does not magically disappear in a mist of mumbo jumbo.

There are enough of us here that know how to move shares that we should be able to generally agree on that process. I find his formula in conflict with his conclusion. In the past days, using his formula, I find more than a dozen days with less than 1. It is possible that my data is flawed and I would be happy for someone to point this out and back it up.

Assuming good data and applying his formula to the data, the number that he starts with 1.

This delta will play prominently in the success or failure of this system. Since his posted formula makes sense, I decided to ignore his conclusions and apply the formula as posted.

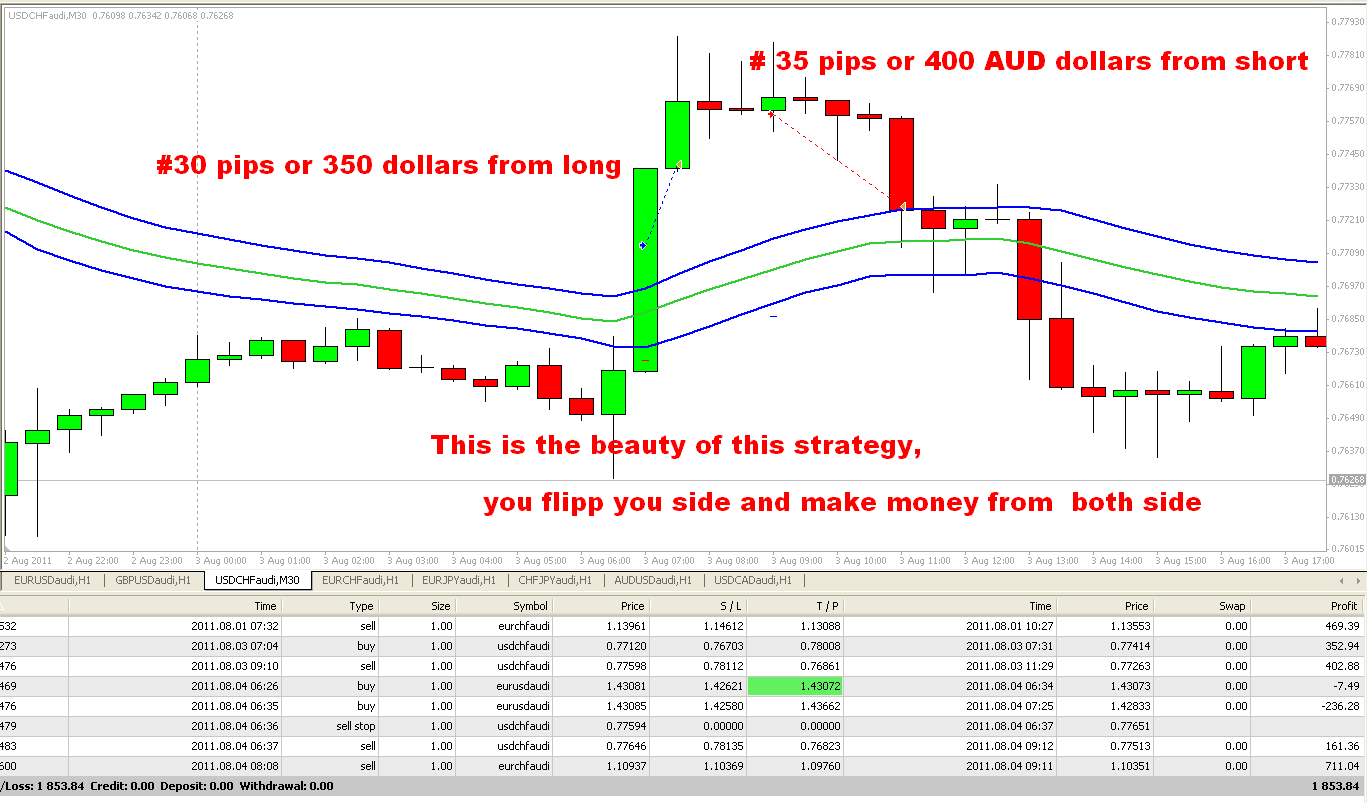

Flipper forex system

I think what he wrote was merely in error and would be surprised if the formula is wrong. In the case of smaller orders this is probably quite close. For larger orders I would expect the slippage to increase even above these calculations.

Abogdan did not post an exact formula for the share multiplier. Following is a brief explanation of how my share multiplier formula works.

The intent of this formula is not unlike a Martingale strategy where one doubles each losing bet at the casino. Here of course one does not lose ones entire stake at each flip so doubling is not necessary. Abogdan originally mentions 1. I constructed the formula as follows: All my calcs and the posted spreadsheet use a penny per share commissions. I moved it up and down and for the test period this setting was the best. Close together obviously results in more flips and farther apart in more slippage.

There are two or three days missing in that time and they are either short market days or the data for that day had obvious problems and I deleted results. I start with an initial shares assumption only because that is what abogdan referred to in initial post. The more slippage incurred wider spread before initial purchase, the more shares it will buy to end up with the expected profit. You will occasionally see less then shares as the initial purchase as negative slippage is encountered.

The "Flipper" strategy | Elite Trader

The last three columns in the spread sheet display profit for three different strategies. Unlimited flips, three max and five max.

These columns are totaled at the bottom. At one point in the original thread abogdan mentions allow a day to go to 11 flips. Clearly according to this test which is just that that would be ruinous. Currently the test bears those initial impressions out and so I still stand by those general positions. I am however very willing to entertain the discussion of flaws in my testing. Questions about my coding are also welcome. From one flip to another, there is like 10 cents of room, what is that for?

You are shorting If the flip line is Only way I can see this not being incorrect is if KLAC has such a huge spread cents!!??

Hi Gary, it's a good question. I think you have a misunderstanding of his system. If we were to use a single line say the I have attached the chart shot from the initial entry and first flip for the day you chose. The red line is the smoothed ask average, the green is smoothed bid, the blue is smoothed trade and the two horizontal purple dashed lines represent the upper and lower flip trigger values and are 3 cents off center each way.

You can see the trades trigger as the dashed lines are crossed. Oh ya, forgot about that. Ok, I understand now.

Binary Option Robot | Automated Trading Software

Those numbers are using the optimal delta? For the test period, 0. I really appreciate the work you've done. I need to go thoroughly through all of this and get back to you with adjustments that are needed for the system. I'm on the road right now and will try to work on it as much as I can. It might take a few days, but that is what the situation is. On the end, we are running the system successfully in our offices so, I'm sure we can make it work in WLD.

Ok, I have 15 minutes. First of all, it is really hard for me to follow your code but I'll try to make general comments that jump out right away. This gives you an idea of how many shares do you need to hold to pay for all the flips plus your target profit. The way we calculate this is following: So at any time your Holding shares should be calculated from the following equation: If you have reached Max amount of flips in our case it was 11 you are not looking to make profit anymore rather your target is the losses that you encounter so far.

This eliminates a lot of losses including days when there is not enough percentage gain. There are some other things that we do to make it better, but I need to spend more time to describe them.

Zero Tolerance 0456 Sinkevich Flipper OverviewPlease let me know whether this was helpful. Again it does work. It just a little bit more complex than the rough concept that I have described. You must log in or sign up to reply here. Your name or email address: Do you already have an account? No, create an account now. Yes, my password is: Forums Forums Quick Links. Search titles only Posted by Member: Separate names with a comma.

Search this thread only Search this forum only Display results as threads. Style Modern Layout V2 Contact Help Advertise Home Top RSS. ET IS FREE BECAUSE OF THE FINANCIAL SUPPORT FROM THESE COMPANIES:.