Books on short selling stocks

Short Selling Related Books See also: Short Selling Related News , Short Selling Related Scholarly Papers , or Short Selling Home Page.

Shim All About Hedge Funds by Robert A. Jaeger The Art of Short Selling by Kathryn F. Staley The Handbook of Alternative Assets by Mark J. Anson How to Make Money Selling Stocks Short by William J. O'Neil, Gil Morales Safe Strategies for Financial Freedom by Van K. Barton, Steve Sjuggerud Selling Short by Joseph A. Walker Short Selling by Frank J. Fabozzi, Cliff Asness Short Term Trading, Long-Term Profits by Jon Leizman The Streetsmart Guide to Short Selling by Tom Taulli The Successful Investor by William J.

O'Neil What is Short Selling?

The reader can learn what these measures are, who's compiling them, where they are easily found, and how they can, or cannot, be used to guide investment decisions. It provides fast and reliable explanations for all of the everyday terms and tools investors need, each discussed in an easy-to-follow, structured format covering: How is it used for investment decision? Are there any words of caution? Jaeger Average Customer Review: All About Hedge Funds debunks these myths and explains how any investor can take advantage of the high-potential returns of hedge funds while incorporating safeguards to limit their volatility and risk.

This clear-headed, commonsense guide tells investors: Staley Average Customer Review: Regularly falling in and out of favor, the discipline remains one of the financial market's highest-risks but most profitable practices.

The Art of Short Selling by Kathryn Staley, an expert in the field, uses examples and instructions to show how it can be done successfully--while cautioning that it "is not for the faint of heart. Anson Average Customer Review: Hedge funds and private equity are the best known of the alternative assets, but certainly not the only alternative assets available.

How To Make Money Short Selling Penny StocksThe author explores each one of these alternative asset classes in detail, providing practical advice along with useful research. Book Info Offers a comprehensive examination of the four major classes as presented in the 'Handbook of Alternative Assets'.

Merges data and strategies scattered in numerous volumes into one handy guide for the serious investor.

10 Potential Short Selling Candidates for | InvestorPlace

Discusses hedge funds, private equity, credit derivatives, and commodity and managed futures. O'Neil, Gil Morales Average Customer Review: In the stock market there is only one side the right side.

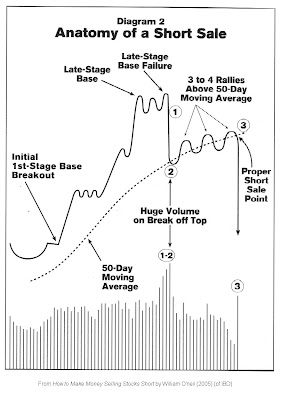

In certain market conditions, selling short can put you on the right side, but it takes real knowledge and market know-how as well as a lot of courage to assume a short position. The mechanics of short selling are relatively simple, yet virtually no one, including most professionals, knows how to sell short correctly.

In How to Make Money Selling Stocks Short, William J. O'Neil offers you the information needed to pursue an effective short selling strategy, and shows you with detailed, annotated charts how to make the moves that will ultimately take you in the right direction. From learning how to set price limits to timing your short sales, the simple and timeless advice found within these pages will keep you focused on the task at hand and let you trade with the utmost confidence. Barton, Steve Sjuggerud Average Customer Review: Safe Strategies for Financial Freedom shows you how to know in 30 seconds whether you should be in or out of the market.

The authors show you how great investors avoid mistakes--and win big. With Van Tharp's legendary risk-control techniques, learn how the world's most profitable investors reduce their risk and leave their wealth-generating potential unlimited, and how you can too. You'll learn how to invest wisely--in every type of market, protecting what you earn, and developing sources of regular income to achieve financial independence.

Safe Strategies for Financial Freedom provides you with a specific program for freeing yourself from the workplace--forever. Let it show you how to seize control of your financial life by investing in the assets that will provide you with steady income until the day when your investment income surpasses your monthly expenses--and you are, once and for all, financially free.

Procedural and regulatory requirements are mixed with actual case studies and examples that readers can apply to specific situations.

Error (Forbidden)

Risks and rewards of short selling are discussed in detail as are short selling as a tool for protecting other investments and for speculation. Fabozzi, Cliff Asness Average Customer Review: The Theory and Practice of Short Selling offers managers and investors the information they need to maximize and enhance their short selling capabilities for bigger profits.

Frank Fabozzi collects a group of market experts who share their knowledge on everything from the basics to the complex in the world of short sales, including mechanics of short selling, the empirical evidence on short-selling, the implications or restrictions on short selling for investment strategies, short-selling strategies pursued by institutional investors, and identifying short-selling candidates.

Fabozzi, PhD, CFA New Hope, PA , is the Frederick Frank Adjunct Professor of Finance at Yale University's School of Management and Editor of the Journal of Portfolio Management.

Error (Forbidden)

He is the author or editor of over books on finance and investing. Short-Term Trading, Long-Term Profits explains how to learn the ropes and lay the necessary foundation to become a successful short-term trader. Sidestepping the costly trial-and-error learning process that has forced many traders to leave the arena prematurely, before they truly understood the rules, this timely book provides specific, practical guidelines and strategies for integrating short-term trading into an overall portfolio and financial plan.

Short-Term Trading, Long-Term Profits acts as a solid bridge between the volatile world of day trading and the more traditional world of the long-term, buy-and-hold investor.

Providing every tool the short-term trader needs from specific strategies for momentum trading and short selling to fundamentals of economic and market environment it is the first book to effectively, honestly shorten the time frame for learning to be an effective short-term trader.

Why there are only 3 books on short selling | stockbee

He explains short-selling strategies in terms that individual investors can understand. O'Neil Average Customer Review: Showing how mistakes made in the recent market collapse were amazingly similar to those made in previous down cycles, O'Neil reveals simple steps investors can follow to avoid costly mistakes. What Is Short Selling? How to bolster portfolio performance How to spot an excellent short sale candidate Hedging and speculating.

Please keep in mind that some of the content that we make available to you through this application comes from Amazon Web Services. All such content is provided to you "as is". All About Hedge Funds by Robert A. The Art of Short Selling by Kathryn F.

The Handbook of Alternative Assets by Mark J. How to Make Money Selling Stocks Short by William J. Safe Strategies for Financial Freedom by Van K. Selling Short by Joseph A. Short Selling by Frank J. Short Term Trading, Long-Term Profits by Jon Leizman Average Customer Review: The Streetsmart Guide to Short Selling by Tom Taulli Average Customer Review: The Successful Investor by William J. There are substantial risks in investing in Hedge Funds. Persons interested in investing in Hedge Funds should carefully note the following: Hedge Funds represent speculative investments and involve a high degree of risk.

An investment in a Hedge Fund should be discretionary capital set aside strictly for speculative purposes. An investment in a Hedge Fund is not suitable or desirable for all investors. Only qualified eligible investors may invest in Hedge Funds. A Hedge Fund may have little or no operating history or performance and may use hypothetical or pro forma performance which may not reflect actual trading done by the manager or advisor and should be reviewed carefully.

Investors should not place undue reliance on hypothetical or pro forma performance. A Hedge Fund may use a single advisor or employ a single strategy, which could mean a lack of diversification and higher risk. A Hedge Fund for example, a fund of funds and its managers or advisors may rely on the trading expertise and experience of third-party managers or advisors, the identity of which may not be disclosed to investors A Hedge Fund may involve a complex tax structure, which should be reviewed carefully.

A Hedge Fund may involve structures or strategies that may cause delays in important tax information being sent to investors. A Hedge Fund may provide no transparency regarding its underlying investments including sub-funds in a fund of funds structure to investors.

A Hedge Fund may execute a substantial portion of trades on foreign exchanges or over-the-counter markets, which could mean higher risk.

In a fund of funds or similar structure, fees are generally charged at the fund as well as the sub-fund levels; therefore fees charged investors will be higher that those charged if the investor invested directly in the sub-fund s.

Hedge Funds are not required to provide periodic pricing or valuation information to investors. All performance information is believed to be net of applicable fees unless otherwise specifically noted. No representation is made that any fund will or is likely to achieve its objectives or that any investor will or is likely to achieve results comparable to those shown or will make any profit at all or will be able to avoid incurring substantial losses.

Past performance is not necessarily indicative, and is no guarantee, of future results. The information on the Site is intended for informational, educational and research purposes only. Nothing on this Site is intended to be, nor should it be construed or used as, financial, legal, tax or investment advice, be an opinion of the appropriateness or suitability of an investment, or intended to be an offer, or the solicitation of any offer, to buy or sell any security or an endorsement or inducement to invest with any fund or fund manager.

No such offer or solicitation may be made prior to the delivery of appropriate offering documents to qualified investors. We do not provide investment advice and no information or material on the Site is to be relied upon for the purpose of making investment or other decisions. Accordingly, we assume no responsibility or liability for a ny investment decisions or advice, treatment, or services rendered by any investor or any person or entity mentioned, featured on or linked to the Site. The information on this Site is as of the date s indicated, is not a complete description of any fund, and is subject to the more complete disclosures and terms and conditions contained in a particular fund's offering documents, which may be obtained directly from the fund.

Certain of the information, including investment returns, valuations, fund targets and strategies, has been supplied by the funds or their agents, and other third parties, and although believed to be reliable, has not been independently verified and its completeness and accuracy cannot be guaranteed. No warranty, express or implied, representation or guarantee is made as to the accuracy, validity, timeliness, completeness or suitability of this information.

Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. Comparisons to indexes have limitations because indexes have volatility and other material characteristics that may differ from a particular hedge fund. For example, a hedge fund may typically hold substantially fewer securities than are contained in an index.

Indices also may contain securities or types of securities that are not comparable to those traded by a hedge fund. Because of these differences, indexes should not be relied upon as an accurate measure of comparison.

Rushmore Securities LLC by Barclay Trading Group, Ltd. Rushmore Securities LLC, Member NASD, SIPC.