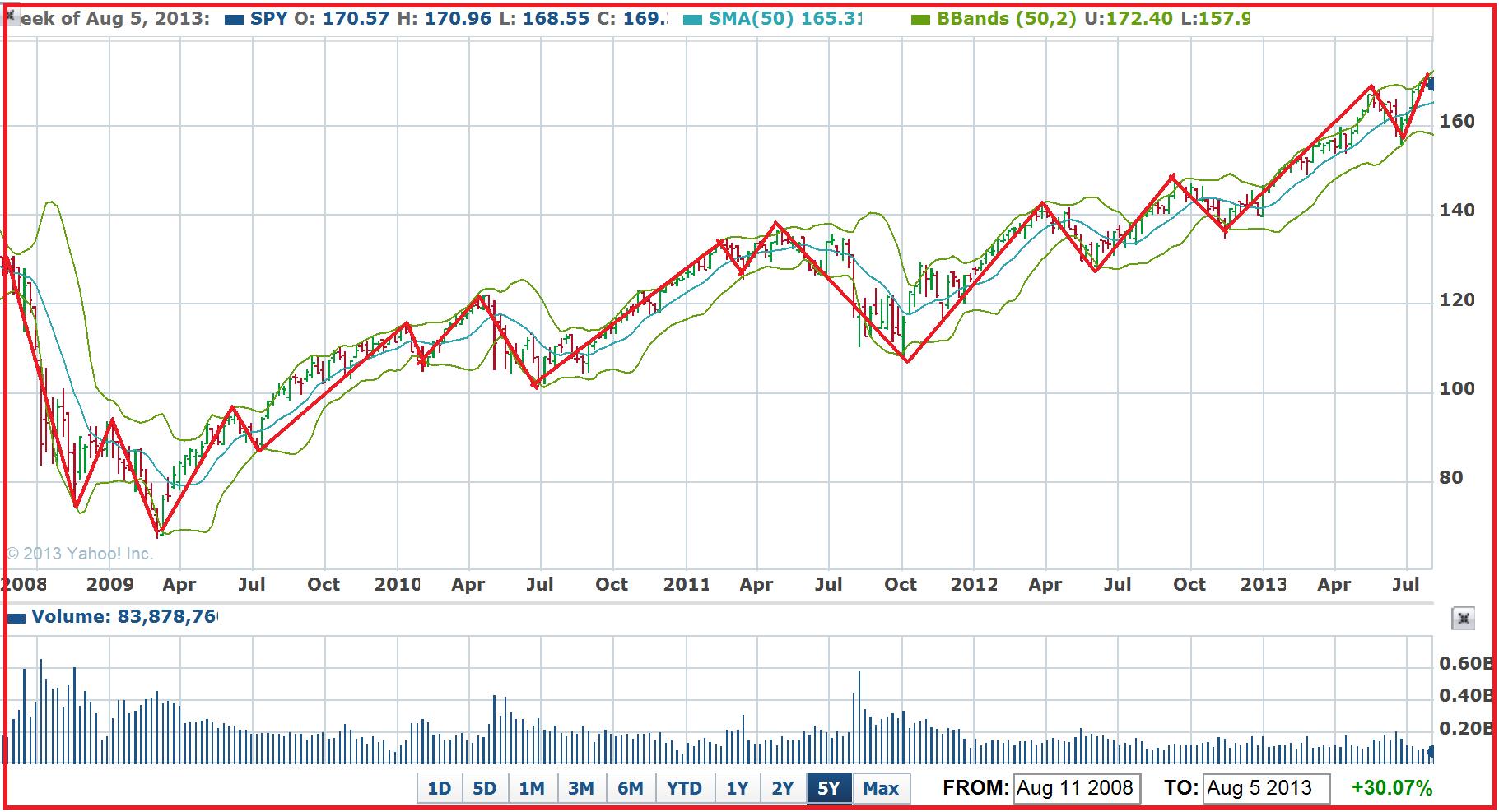

Short term stock market predictions

However, the market is deciding for us, at the beginning of the month, rather than the end, what we can expect.

Mastering Short-Term Trading

You can argue the market is too high, you can argue Washington is mired in chaos, you can argue the seasonal behavior of investing is against us, however you cannot argue with the technical analysis of this market AS I SEE IT…. If you are already long, great.

If you are inclined to make good bets on some climbing stocks, especially the techs, then look up some of the names or stock symbols in my last blog, read about them, check out their charts, then buy something! I am a person that respects signs.

One of my personal indicators is Steelcase, symbol SCS. It looks like this company, which I consider a harbinger of US business health, is strongly turning up. It was so heavy I could barely get it into my car. Kiss the Sky and Say Goodbye indeed! So where does the market go from here? Positive signs include a nice rebound on Thursday and Friday, tech stocks still jumping, the China stocks soaring, and sentiment hellbent on good news regardless of what is watched in the political sphere.

On the negative side we have a market still trying to overcome the level with catalysts that seem tired like tax reform, infrastructure, military buildup. And with interest rates dropping rather than climbing, that means the financials and the banks perform so-so, and without strong financials, the stock market languishes. Another negative according to the Stock Traders Almanac is that we have switched from the best 6 months to the worst 6 months except for techs and small caps, and even the small caps are starting to waver….

But this blog is all about where I stand, and instead of having no opinion, I try to form my own and here it is: I see more of a moderating decline, until the seasonal bad wind is behind us and a new catalyst appears that will jolt the market higher on big volume.

Once that day comes I will utilize some cash and jump in with both feet. Due to short-term highs overbought and earnings coming out, possible buys more risky China stocks to watch are Baozun BZUN , a Chinese video site, Weibo WB the Chinese Twitter, and SINA the owner of JD. Other interesting buys in my own order of possible buy conviction are: Incidentally, I continue to hold my high dividend oil and gas payers, British Petroleum BP, and Oneok OKE.

I am also looking into a few reverse ETFs and bear call spreads but have nothing significant to report at this time. I recently took profits in several issues like DATA and BZUN, and will watch their behavior vis-avis the stock market index average performance before I buy back in. I also had a few losses naturally, the worst last week for me was Foot Locker FL. We shall see what the rest of this year brings us.

But in the meantime…. If I do say so myself, that was a great call I made 2 weeks ago. By now, if you have been following my proprietary Hyperbolic Selling Strategy, you should be mostly in cash, with any bullish exposure allocated to only your strongest stocks.

The Trump Rally is indeed turning into the Trump Slump. We all do not know the full extent of it, but it started on March 1st. After the failure to overturn Obamacare, Paul Ryan admitted that the party of No needs to learn how to govern. This is going to be harder than passing Trumpcare. The second factor is Trump himself. His weltanshauung worldview is unreliable as he changes advisors, and leaves the military to make decisions that he should make.

He was against NATO, China, EX-IM Bank, bombing Syria, and that all reversed in 1 week! The last factor is the biggest. Look at the market itself. While it may pop next week over Netflix earnings or some other positive catalyst, the turn has been made…financials are declining, defensive stocks like utilities and bonds are improving, and the last shoe to drop will probably be tech.

For the past 8 years, this blog has been devoted to taking a directional position, which is difficult, because forecasting the stock market is hard. Believe it or not, forecasting the NFL is way more difficult, but with me, regarding the stock market, you have a fighting chance. Will they try the Republican tactic of sabotage until the 11th hour over Planned Parenthood, or some other favorite Democrat trope? Be smart and listen to me -LOL.

Where am I right now. The few stocks that I own are Netflix NFLX, and MOMO. Those with questions can email me privately. But I refuse to make a prediction until we get closer to mid summer. April is usually one of the best stock market months with average gains of 2. If the market looks like it is going to end the day, middling to down, then continue with the plan and raise more cash.

You may forfeit a few nice point gains later in April, but the reward on risk will not be worth it. What is reward on risk? That means a 1: You should be selling, shorting, selling calls, buying puts, buying reverse ETFs to capitalize on the mini-correction coming. If I had known I would have put all of my funds into the indexes.

These instruments give me a chance to profit in all types of markets. There is more ahead for this bull. But the market has definitely stubbed its toe along with President Trump stubbing his second toe since gaining office. I think the next few weeks could remain negative, so if you have been adopting my posture of selling double your previous selling amount every Monday for 6 weeks, keep doing that.

Trump took a beating but he is learning how to deal with Congress. After calling the up move a month ago, boy have we climbed. While I expect some breathing into sideways action, although we are extremely high, no doubt about it, I think we have a few weeks before any significant correction. Selling has been an infrequently discussed topic in this blog.

Forecast For The U.S. Stock Market Is CAUTION

Some people use candlestick patterns. Some people hedge by just shorting the stock you own and just waiting until the selling hits a new low, buy back your shorts and let your long position ride higher. Really risk averse people like myself sometimes just sell the whole thing, hide out in cash, and come out buying at the first sign of a low. Honestly, I think the market goes higher this year. In the past I have noticed nasty spills in the market in June.

That maxim may be overdue to be true. Let me give you an example. In a decline, 3 out of every 4 stocks go down regardless of what they are. Here are the 6 weekly percentage selling factors: If the correction starts earlier sell it all at once. It is a flexible selling program. But notice the binomial selling, the doubling at each sell, which allows your investment to work, as you exit slowly, capturing gains and profits before the inevitable correction.

Usually, it is best to sell on Mondays, because the beginning of the week is when the mutual funds and other big players deploy the mountains of cash from their K holders. More specifically, in the above example, that means I would sell 1.

The above selling program is not for everyone. Or a couple more months, then it ends in a big dip or a correction. However I will give no new recommendations this week because I think whatever you buy will probably be lower in June. How do I know this? First of all, the Volatility Index called the Vix for short is perilously low at It can stay low for a while, but not forever.

Secondly, a couple of my recent picks have done well like WD which I sold because of a huge gain in a short amount of time, and MCHP which went higher. However, 2 of my picks were scarred by earnings reports last week for GRUB and UBNT. I lucked out with ANET and doubled my holdings at the recent low and gambled on a return to recent highs and that paid off. Despite that success I will probably sell it or buy protective puts due to its upcoming earnings to be reported this week.

If not for these ugly blemishes, investing would be less risky, but probably not as rewarding. Our starship Icarus is getting a zephyr like blast from the Sun, not enough to sink it, but enough to say be careful. Like my friend John, I will be emphasizing Iron Condor trading for the next few months instead of outright buys.

Start your gradual sell programs. By the time the end of April rolls around, I should be left only with my strongest stocks and options, and a bundle of cash. Any issues dropping to recent lows, I will sell, and anything hitting decent highs I will also sell. Having said everything above, there remains a lot to like out there such as the FANG stocks and almost anything being promoted by Trump such as oils, financials, materials, and discretionary.

For noobie investors, I have previously discussed my short paper called Hyperbolic Investing and if you want a copy to start your investing portfolio, just contact me. If you have questions or want to reach me, I am ebonaduce on Twitter or friend me on LinkedIN.

Just like our new President is testing how far he can go with reversing previous policies, our stock market is doing the same with respect to testing previous limits associated with market tops. Com peak, and higher than what it was in So will we keep forging higher without a significant dip? The answer I think, at this point is yes. Certain major high cap stocks such as Goldman Sachs, JP Morgan Chase, and Bank of America in the financial arena, and the FANG stocks like Facebook, Amazon, Netflix, and Google in the tech space appear nearly motionless compared to their recent highs and are slowing down like a bunch of photons in a vat of Einstein-Bose condensate.

But it keeps defying the odds, with volatility low and headed lower. Rebounders, from which I made the majority of my gains last year and hoping to do the same this year, are Chipotle CMG with their recent earnings miss, a great time to pick up stock or options , Polaris PII, Alexion ALXN, Yamana Gold AUY, CenturyLink CTL, Vodaphone VOD, Kimberly Clark KMB, Eagle Pharmaceuticals EGRX, Carnival Cruise Lines CCL, General Mills GIS, Lyondell Basell LYB, and Exxon Mobil XOM.

Now that the inauguration is out of the way, we can get back to minding the market. I foresee a continuation of the the sideways pattern. The mixed behavior of the indexes mentioned last week is the cause. The only bright spot holding the market up is technology.

I cleaned out a lot of my stock inventory last week and many of my call options. This is rotational in nature, as I want to take what profits I have before losing them, and rotate into some better names.

For stocks I am long ANET which took a nasty tumble on Monday , OKE, VZ, and a new one Applied Materials AMAT an old name in tech that seems to be focusing their products on the future.

I sold most of my calls except NFLX what a nice earnings bounce on Thursday , POT, YRCW, CCL, DEO, and PAYC. I remain positive on the following through sold puts technique discussed last week related to Apple Apple AAPL, Netflix NFLX, Gilead GILD, General Mills GIS , Kimberly Clark KMB, LyondellBasell LYB, Polaris PII, and Disney DIS. I also have lots of Iron Condors on the indexes and a few stocks like Priceline PCLN, but a discussion for those is quite complicated and will wait for another day.

While remaining cautiously color yellow! Look at the stars Look how they shine for you And everything you do Yeah they were all yellow. However, how long can they stay up until we hear more about infrastructure borrowing from the new administration. On the other hand I still favor oil or telecom so will stick with Oneok and Verizon for now. I have tantalized for months since my declaration of having found a way to make money in Apple stock by NOT owning it and not caring whether it goes up or down within reason.

As far as the outlook is concerned, the markets are trifurcating or quadfurcating a little bit, if I can coin some words here. The Nasdaq is making new highs with the famous FANG stocks on a tear. And the DOW Jones…what the hell…is it going to cross 20, or not? Before the inauguration or not? And nobody knows the future. As for stocks I still hold ANET, FMSA, GKOS a Glaucoma drug outfit , LCII, SQ, OKE, VZ, and JPM and INCR for now. I also added a spec play called Energous, symbol WATT, which is rumored to be working on a new wireless charging feature for all iPhone 8 and future Apple devices.

For call options I am long aapl, baba, ccl Carnival Cruises, deo, dis, fb, nflx, payc, txn Texas Instruments, pot, v, and yrcw. I may be dumping or rolling some of these next Friday when options expire for January.

I got this idea from JJ Kinahan during a lecture he gave at an investment conference that I attended last August. It is not an original idea, selling puts, but JJ was passing it along as something that he does regularly in his portfolio to make some extra cash.

You sell what is called a put or puts on Apple stock for a certain strike price and for a particular calendar date in the future. A put gives a buyer the right to sell you his stock for a certain price by a certain date. For example, Apple is currently selling for dollars a share. And the shares he is dumping are expensive! So the strategy is not without risk! Here, punish me, make me buy Apple at a deep discount and pay me to do it. Using this strategy I have made between and per month from Apple for the past 3 months.

Example, if you sold puts to make 10, a month and had , at risk, do you really want to have all of your eggs in that basket? Apple can go up one day and down the next, but as long as it stays away from my strike price, no problem, so rest easy. And worst case I own Apple at a big discount, poor me! Hug the Floor and Say Goodbye…………….. Kiss the Sky and Say Goodbye — The Sequel…………………..

Wendy Kirkland

But in the meantime… Happy Investing! Kiss the Sky and Say Goodbye………………………. Be smart and listen to me -LOL Where am I right now. Happy Investing to All! The market is going to plunge points on Monday!!!! APRIL FOOLS Now that should get your attention!

If you are long-term or intermediate term, just hang in there, and keep investing. Like I said, I remain bullish and cautiously optimistic, but keep your eye on the exit door.

Green Turns to Yellow………………….. As Coldplay would sing it: Look at the stars Look how they shine for you And everything you do Yeah they were all yellow SNAP! SELLING PUTS ON APPLE I got this idea from JJ Kinahan during a lecture he gave at an investment conference that I attended last August.

Recent Posts Hug the Floor and Say Goodbye……………..

June 1 Kiss the Sky and Say Goodbye — The Sequel………………….. May 20 Kiss the Sky and Say Goodbye………………………. April 15 Welcome To the Pivot Point………………April 1 Stubbing Toes…………………………Mar 26 Wings Still Intact…………………. Mar 5 Icarus Cruising Ever So Higher……………………Feb 12 Testing Our Limits……………………………….. Feb 5 Coasting For Now…………………. Jan 21 Green Turns to Yellow…………………..

Categories Short-term stock market forecast. Archives June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August May April March February January December November October August July April February January December October September August July June May April February January December November August May April March February January Blogroll Development Blog Documentation DreamHost Blog Plugins Suggest Ideas Support Forum Themes WordPress Planet.

RSS Comments RSS Valid XHTML.