Unrealized gain or loss on foreign exchange

When a company headquartered in one domestic country executes a transaction with a company in another foreign country using a currency other than the domestic currency, one currency needs to be converted into another to settle the transaction.

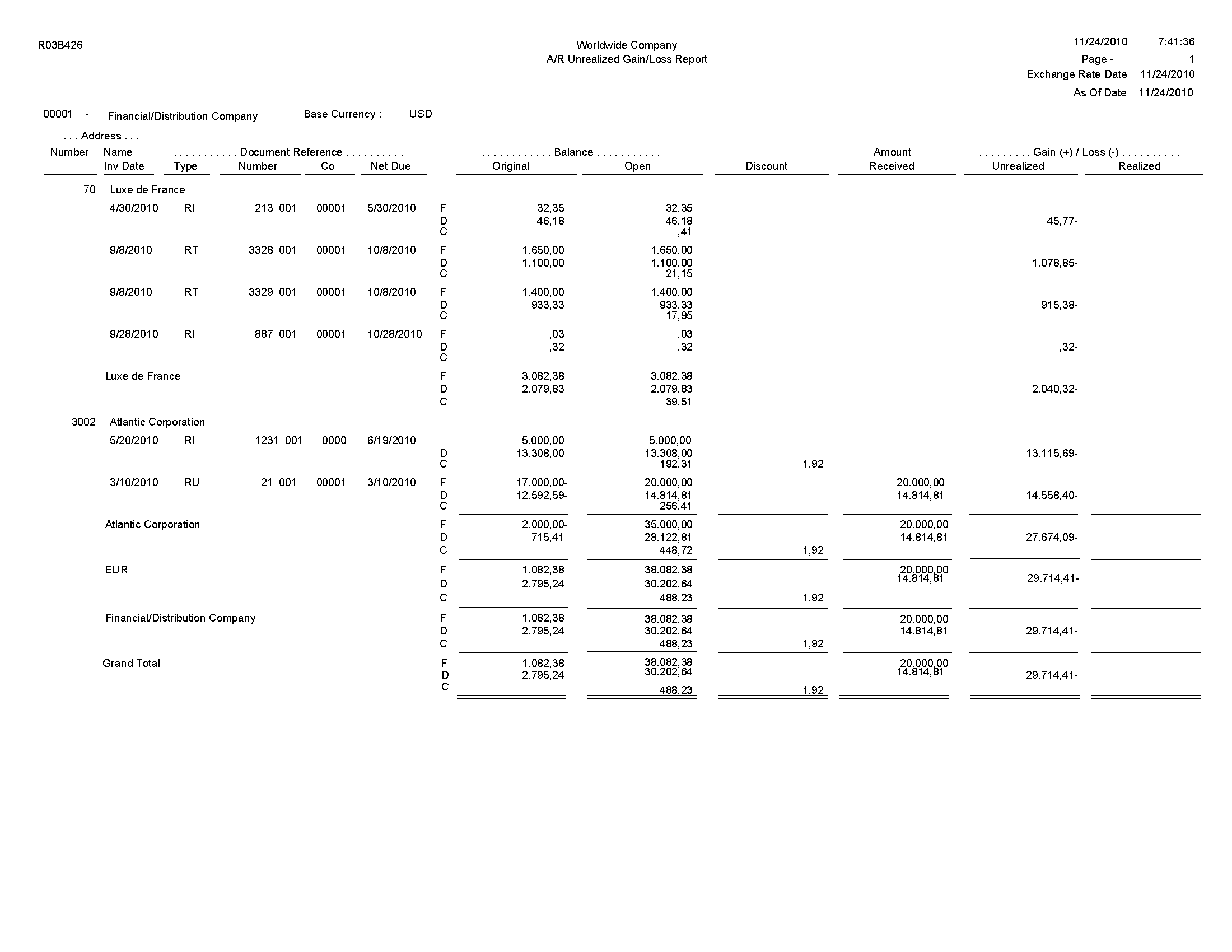

This conversion from one currency to another creates gains and losses depending on the currency exchange rate. Realized currency exchange gains and losses can occur when full or partial payments are applied to voucher or invoice amounts.

Gains and losses are calculated on each payment amount instead of the outstanding voucher or invoice amount. In the following examples, the transactions were completed by the receipt of the payment of cash. Therefore, any exchange gain or loss was realized and, in an accounting sense, was recognized on the date of the cash receipt or cash payment. For example, a U. This exchange of one currency into another involves the use of an exchange rate. The foreign exchange rates used in this example do not reflect current rates.

Payment of Invoice from Sterling Co. Special accounting problems arise when the exchange rate fluctuates between the date of the original transaction such as a purchase on account and the settlement of that transaction in cash in the foreign currency such as the payment of an account payable.

In practice, such fluctuations are frequent. In this case, the U.

The cash payment would be recorded as follows:. All transactions with foreign companies can be analyzed as in the examples above. The transaction would be recorded as follows:. The receipt of the cash would be recorded as follows:.

What are unrealized gains and losses? | Investopedia

When the balance is not paid in full, however, the system calculates currency gains and losses on each payment amount instead of the outstanding voucher or invoice amount.

For example, a German company purchasing items from an U.

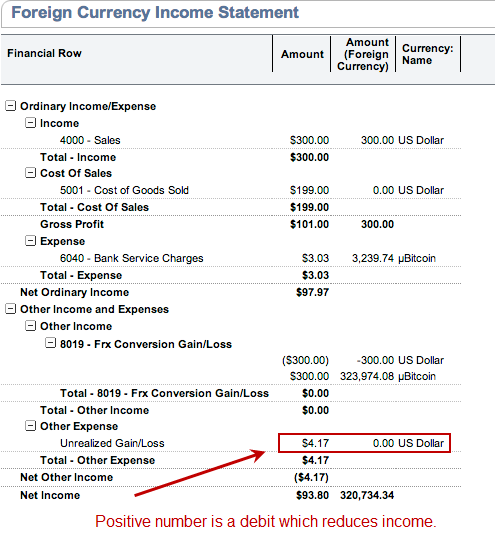

Accounting for Foreign Currency TranslationsIn this case, the German company is making partial payments rather than paying the balance in full. The transaction would occur as follows:. The German company purchases items from the U. However, if financial statements are prepared between the date of the original transaction sale or purchase on account, for example and the date of the cash receipt or cash payment, and the exchange rate has changed since the original transaction, an unrealized gain or loss must be recognized in the statements.

This "unrealized" loss would be recorded as follows:.

About Realized and Unrealized Gains and Losses

The cash receipt would be recorded as follows:. If the exchange rate had increased between December 31 and January 19, an exchange gain would be recorded on January A balance in the exchange loss account at the end of the fiscal period should be reported in the Other Expenses section of the income statement. A balance in the exchange gain account should be reported in the Other Income section.

Realized and Unrealized Gains and Losses • The Strategic CFO

Before the financial statements of domestic and foreign companies are consolidated, the amounts shown on the statements for the foreign companies must be converted to domestic currency. Asset and liability amounts are normally converted to domestic currency by using the exchange rates as of the balance sheet date.

Revenues and expenses are normally converted by using the exchange rates that were in effect when those transactions were executed. For practical purposes, a weighted average rate for the period is generally used.

The adjustments gains or losses resulting from the conversion are reported as a separate item in the stockholders' equity section of the balance sheets of the foreign companies. After the foreign company statements have been converted to domestic currency, the financial statements of domestic and foreign subsidiaries are consolidated in the normal manner.

For more information, see Consolidation Overview. About Realized and Unrealized Gains and Losses menuOverviewWebFn ; menuOpenFormWebFn '' ; menuHowToWebFn ; menuSeeAlsoWebFn ;. This topic covers realized and unrealized currency exchange gains and losses. Realized Currency Exchange Gains and Losses Realized currency exchange gains and losses can occur when full or partial payments are applied to voucher or invoice amounts.

Balance Paid in Full In the following examples, the transactions were completed by the receipt of the payment of cash. May 1 Accounts Receivable - Crusoe Co.