Forward fx trading

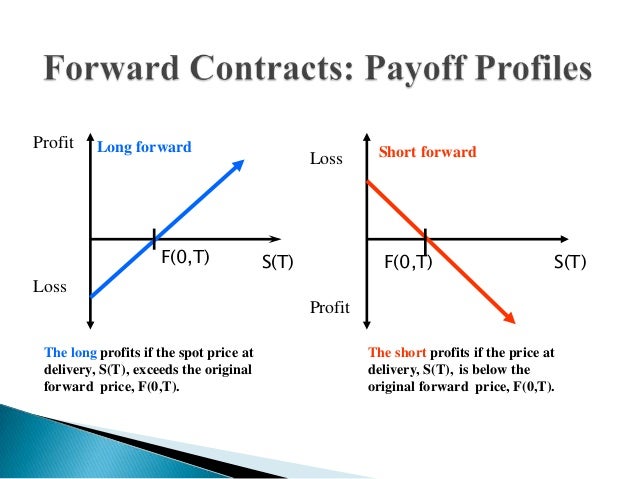

A forward transaction in the foreign exchange market is a contractual agreement to take part in a currency transaction on a date other than the spot value date at a specific rate of exchange. More on the spot transaction.

Understanding Forex Forward Transactions - laqenyberegi.web.fc2.com

Also known as a forward outright contract, forward contract or forward cover, a forex forward transaction generally involves buying one currency and selling another at the same time for delivery at a particular rate on the same date other than spot. The Interbank forward market generally trades for standardized value dates, sometimes called straight dates, like one week, one month, two months, three months, six months, nine months and one year from the spot date.

Forwards with value dates that do not conform to these straight dates are sometimes called odd date forwards. They are used by many bank customers who may ask for forward contracts with dates tailored to their specific hedging needs.

The forward prices for odd dates are usually determined from the pricing for the surrounding straight dates that can be readily obtained from the market.

The forward value or delivery date is simply the agreed upon date for mutual delivery of the currencies specified in a forward contract.

Euro FX Futures (EUR/USD) Quotes - CME Group

This date can be days, months or even years after the transaction date. Furthermore, how the exchange rate moves between the forward transaction date and its value has little impact, other than perhaps from a credit risk standpoint. This is because the counterparties have already agreed upon a rate of exchange for the currencies involved that will be used when the value date for settlement of the currencies finally arrives.

Since the value of forward contracts moves more or less in tandem with the spot rate, executing a forward transaction usually involves first doing a spot trade in the desired currency amount to fix that more volatile portion of the forward price. To then obtain the forward rate, the counterparties will add or subtract from the spot rate the forex swap points for the desired forward value date that pertain to the particular currency pair involved.

The forex swap points are determined mathematically from the net cost involved in lending one currency and borrowing the other during the time frame covered by the forward contract.

.jpg)

In general, the carry will be positive for selling the currency with the higher interest rate forward and will be negative for buying the currency with the higher interest rate currency forward. The cost of carry will be more or less neutral for pairs of currencies that have the same interest rates. More on carry trading. Trading the spot market versus futures trading. Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors.

The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you. OptiLab Partners AB Fatburs Brunnsgata 31 28 Stockholm Sweden Email: You are using an outdated browser.

Please upgrade your browser to improve your experience.

Online Forex Broker | Best Forex Broker | IKOFX

World's best forex deals and strategy. The Forward Value Date The forward value or delivery date is simply the agreed upon date for mutual delivery of the currencies specified in a forward contract. Executing a Forward Transaction Since the value of forward contracts moves more or less in tandem with the spot rate, executing a forward transaction usually involves first doing a spot trade in the desired currency amount to fix that more volatile portion of the forward price.

Forwards and the Cost of Carry The forex swap points are determined mathematically from the net cost involved in lending one currency and borrowing the other during the time frame covered by the forward contract. Sign Up Free Demo.