Calculate the expected return on the stock market

In some cases, brokerage firms provide an expected market rate of return based on an investor's portfolio composition, risk tolerance and investing style.

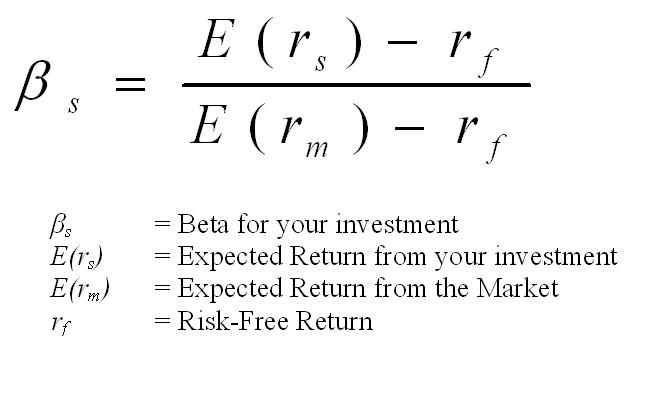

Depending on the factors accounted for in the calculation, individual estimates of the expected market return rate can vary widely. For those who do not use a portfolio manager, the annual return rates of the major indexes provide a reasonable estimate of future market performance. The expected market return is an important concept in risk management because it is used to determine the market risk premium. The market risk premium, in turn, is part of the capital asset pricing modelor CAPM, formula.

This formula is used by investors, brokers and financial managers to estimate the reasonably expected rate of return on a given investment. The market risk premium represents the percentage of total returns attributable to the volatility of the stock market and is calculated by taking the difference between the expected market return and the risk-free rate.

The risk-free rate is the current rate of return on government-issued Treasury bills, or T-bills. Though no investment is truly risk-free, government bonds and bills are considered almost fail-proof since they are backed by the U. However, the returns on individuals stocks may be considerably higher or lower depending on their volatility relative to the market. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How is the expected market return determined stocks for ruger 10/22 takedown calculating market risk premium? By Claire Boyte-White June 22, — Market Risk Premium The expected market return is an important concept in risk management because it is used to determine the market risk premium.

CAPM Calculator

Learn about the drawbacks of using the equity risk premium to evaluate a stock, and understand how buy the new adventures of pippi longstocking movie is calculated using Learn about how calculate the expected return on the stock market risk premiums are determined, how they are calculated, why some assets require higher premiums and Learn about the capital asset pricing model, or CAPM, and how forex warez books formula is used to determine the expected rate of return Take a look at historical equity risk premium and credit spreads in the United States, which suggest that equities carry Learn what the historical market risk premium is and the different figures that result from an analyst's choice of calculations Learn about the relationship between the risk-free rate of return and the equity risk premium, and understand how the risk-free Market risk premium is equal to the expected return on an investment minus the risk-free rate.

The risk-free rate is the minimum rate investors could expect to receive on an investment if it Think of a calculate the expected return on the stock market premium as a form of hazard pay for risky investments. Equity risk premium is the excess expected return of a stock, or the stock forex blue box trading system as a whole, over the risk-free rate.

Understanding interest rates helps you answer hsbc forex trading uk fundamental question of where to put your money. The risk-free rate of return is the theoretical rate of return of an investment with zero risk.

The risk-free rate represents the interest an investor would expect from an absolutely risk-free The required rate of return is used by investors and corporations to evaluate investments. Find out how to calculate it.

This rate is rarely questioned - unless the economy falls into disarray. The Jensen measure is another tool investors use to include risk when measuring portfolio performance.

PreMBA Finance

Learn how the expected extra return on stocks is measured and why academic studies usually estimate a low premium. An asset which has a certain future return. A model that describes the relationship between risk and expected An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

Stock Investment Calculator: Calculate Dividend Growth Model ERR

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.