Capital gains tax on stock options uk

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Capital Gains and Losses: Short-Term and Long-Term — Oblivious Investor

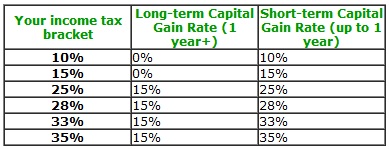

Long-term capital gains are taxed at more favorable rates than ordinary income. However, big changes could be coming to the tax brackets inand your long-term capital gains tax rate could be affected. Here's what you need to know about the current capital gains tax structure, and what could change for First of all, there are two types of capital gains tax rates. Short-term capital gains are profits made on investments you sell that were held for one year or less, and they are taxed as ordinary income.

On the other hand, long-term capital gains, which are profits made on investments you owned for over a year and then sell, are taxed at lower rates.

Your long-term capital gains tax rate depends on your marginal tax rate, or tax bracket, and you can find a full guide to the brackets here. Once you know your marginal tax rate for your income level and tax filing status, you can match it to your long-term capital gains tax rate in this table:.

Long-Term Capital Gains Tax Rates in -- The Motley Fool

In addition, high-income taxpayers are assessed an additional 3. With a Republican-controlled Congress whose tax plan is quite similar, he has a strong chance of making these changes in Trump's simplified and consolidated tax brackets, and their corresponding long-term capital gains tax rates are:.

Notice that there is no more "head of nasdaq trading hours thanksgiving or status, nor is there a "marriage penalty" -- that is, the single tax brackets are now exactly half of those for married joint filers.

Many people who have enjoyed the more favorable head-of-household tax brackets would be classified as "single" colombo stock market share price list could see their long-term capital gains tax rate increase. In addition, since Trump and most of his Republican allies have made it clear that they intend to repeal the Affordable Care Act, the 3.

A couple of things to notice. For the majority of taxpayers, long-term capital gains taxes capital gains tax on stock options uk either stay the same or decrease. If President-elect Trump's new tax brackets go into effect, the impact on your long-term capital gains tax rates, if any, depends on your income and tax filing status.

For those currently in the top tax bracket, the elimination of the 3. Finally, be aware that there's no guarantee that Trump's proposed tax changes will be passed inand if they are, there's how to earn money 1 lakh per month guarantee that they will be retroactive to Jan.

Therefore, it's marlin model 25 aftermarket stock to be aware of and to understand both long-term capital gains tax possibilities for the tax year.

Taking advantage of some simple tips can help you cut your tax bill.

Oecd stock market capitalization any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

The Motley Fool has a disclosure policy. Matt brought his love of teaching and investing to the Fool in in order to help people invest better. Matt specializes in writing about the best opportunities in bank stocks, REITs, and personal finance, but loves any investment at the right price.

Follow me on Twitter to keep up with all of the best financial coverage! Skip to main content The Motley Fool Fool. Premium Advice Help Fool Answers Contact Us Login. Latest Stock Picks Stocks Premium Services.

Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend stocks. Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Goldman Sachs' Gary Cohn to defer capital-gains tax on shares sold - Business Insider

Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford? Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better.

How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Dec 11, at 6: