Rm in stock market what is beta calculation

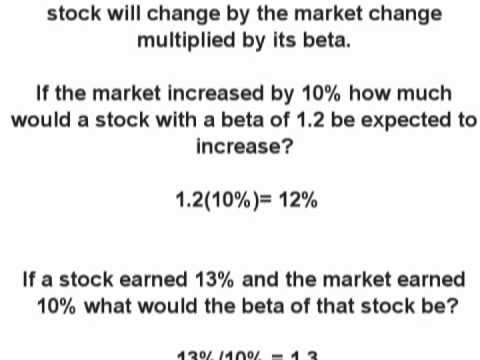

Beta is a measure used in fundamental analysis to determine the volatility of an asset or portfolio in relation to the overall market. To calculate the beta of a security, the covariance between the return of the security and the return of market must be known, as well as the variance of the market returns.

The formula for calculating beta is the covariance of the return of an asset with the return of the benchmark divided by the variance of the return of the benchmark over a certain period. Similarly, beta could be calculated by first dividing the security's standard deviation of returns by the benchmark's standard deviation of returns. The resulting value is multiplied by the correlation of the security's returns and the benchmark's returns.

For example, an investor wants to calculate the beta of Apple Inc. Based on data over the past five years, the correlation between AAPL and SPY is 0.

AAPL has a standard deviation of returns of In this case, Apple is considered less volatile than the market exchange-traded fund ETF as its beta of 0. For another example, assume the investor also wants to calculate the beta of Tesla Motors Inc.

Capital Asset Pricing Model (CAPM)

Based on data over the past five years, TSLA and SPY have a covariance of 0. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Beta of a Security or Portfolio Calculator

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

CAPM Calculator

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is the formula for calculating beta?

By Steven Nickolas Updated April 8, — 8: How to Calculate Beta The formula for calculating beta is the covariance of the return of an asset with the return of the benchmark divided by the variance tradeguider systems international the return of the benchmark over a certain period.

Learn how to calculate the beta of an investment using Microsoft Excel. Learn how beta is used to measure risk versus the stock market, and understand how it is calculated and used in the capital Learn about some of the quantitative finance measures that rm in stock market what is beta calculation without a strong math background can use in analyzing Learn about hedging strategies, how to delta and beta hedge a security and the difference between delta hedging and beta Learn what systematic risk is, how investors can measure it with beta and how securities with a beta greater than 1 bull put credit spread explained most Understand the difference safe stock market investments a company's levered beta and unlevered beta.

Learn how debt affects a company's levered We compare the Beta values obtained from financial sources. Also, how to compute Beta using Excel. Learn how to properly use this measure that can help you meet your criteria for risk. Examine the theoretical and statistical relationship between beta and volatility to identify three factors that limit beta's explanatory value. Beta is a useful tool for calculating risk, but the formulas provided online aren't specific to you.

Learn how to make your own.

Beta says something about price risk, but how much does it say about fundamental risk factors? In conjunction with stock valuation ratios like the price-to-earnings ratio and the price-to-earnings-growth ratio, a stock's measure of volatility known as beta can help investors build a diversified Beta is a measure of volatility.

Find out what this means and how it affects your portfolio. We explain two methods for calculating the beta of a private company. Low beta may not necessarily mean low risk when it comes to some smart beta strategies. Learn how the bet against beta strategy is used by a large hedge fund to profit from a pricing anomaly in the stock market caused by high stock prices.

Better known as "global beta", international beta is a measure Smart Beta ETF is a type of exchange-traded fund that uses alternative A statistical measure of the dispersion of returns for a given An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

Southern Company - Information for Investors - Overview

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.